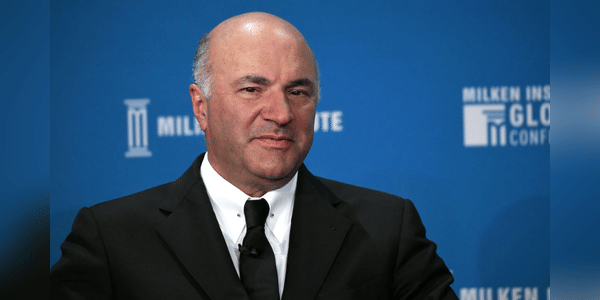

Although the first signs of slowing inflation have emerged, it remains very high. The Fed has already moved to raise interest rates several times this year to slow this worrying trend, with another hike expected at the September 21 meeting. Where to invest specifically in these difficult times was recently revealed by American billionaire Kevin O'Leary.

Companies with pricing power

In the current situation, Kevin O'Leary is looking for companies that are able to raise prices without too much pressure from consumers.

"Where you want to be in equities, especially when rates start going up, are companies that have pricing power," O'Leary says. "In other words, their goods and services are a necessity for people, so they're willing to accept small price increases, sometimes larger ones as prices rise."

But where to find such businesses with pricing power? According to O'Leary, right now the health care industry is looking really good, and the consumer companies are looking really…

Billionaire investor ’Mr. Wonderful’ says the stock market rout is a buying opportunity—especially in China.

As the geopolitical relationship between China and the U.S. frays, billionaire investor Kevin O’Leary—nicknamed Mr. Wonderful—is advising people to invest more in Chinese stocks.

fcchgvcfhcghfgc

how am I good at trading

how am I good at trading, stocks, choosing a classy broker

how am I good at trading, stocks, choosing a classy broker

Please help me

Thanks!

great

https://www.flowcode.com/page/laguerredeslulusstreamingfilmshttps://www.flowcode.com/page/m3ganvoirstreamingfilmshttps://www.flowcode.com/page/babylonvoirstreamingfilmshttps://www.flowcode.com/page/vaincreoumourirstreamingfilmshttps://www.flowcode.com/page/tuchoisiraslaviestreamingfilmshttps://www.flowcode.com/page/maydayvoirstreamingfilmshttps://www.flowcode.com/page/divertimentovoirstreamingfilmshttps://www.flowcode.com/page/retouraseoulstreamingfilmshttps://www.flowcode.com/page/lafamilleasadastreamingfilmshttps://www.flowcode.com/page/pattieetlacoleredeposeidonvfhttps://www.flowcode.com/page/nenehsuperstarstreamingfilmshttps://www.flowcode.com/page/voirtarstreamingfilmshttps://www.flowcode.com/page/unpetitmiraclestreamingfilmshttps://www.flowcode.com/page/andrerieuindublin2023streaminghttps://www.flowcode.com/page/pomponoursstreamingfilmshttps://www.flowcode.com/page/saloumstreamingfilmshttps://www.flowcode.com/page/interditauxitaliensstreamingvfhttps://www.flowcode.com/page/elgatoconbotas2peliculaonlinehttps://www.flowcode.com/page/babylonpeliculaonlinevergratishttps://www.flowcode.com/page/loboferozverpeliculaonlinehttps://www.flowcode.com/page/tarverpeliculaonlinehttps://www.flowcode.com/page/theofferingpeliculaonlinehttps://www.flowcode.com/page/devotionheroespeliculaonlinehttps://www.flowcode.com/page/babylondeutschkostenloshttps://www.flowcode.com/page/m3ganganzerfilmstream

https://www.flowcode.com/page/xemphimnhabanuonlinehttps://www.flowcode.com/page/xemphimm3ganfullonlinevietsubhttps://www.flowcode.com/page/phimbacthaykiemdaofullhdonlinehttps://www.flowcode.com/page/xemchichiemem2phimonlinehttps://www.flowcode.com/page/xemphimavatar2vietsubfullhdhttps://www.flowcode.com/page/pororoxemphimfullhdvietsub2023https://www.flowcode.com/page/xemphivutoansaofullhdvietsubhttps://www.flowcode.com/page/phimmeobeosieudangonline

nice