Passive income is something every investor who has ever looked at dividend stocks would like to achieve. ETFs, however, are often seen as a safer or easier option for many investors. But is it possible to build passive income with ETFs? The answer is: Yes. In today's article, we'll take a look at 3 stable ETFs that are delivering promising performance and paying a fat dividend to boot.

Do you prefer ETFs or stocks?

ETFs are often purchased by investors who like safety and more certainty, as picking individual stocks can be more challenging, but also riskier. After all, I understand the idea of someone putting their money into an ETF that targets hundreds to thousands of stocks, which will also create decent diversification and, in the case of the ones I've chosen, help generate passive income.

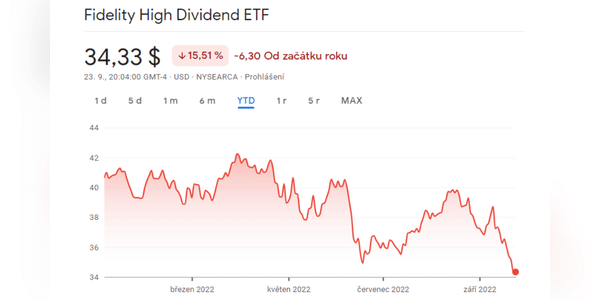

Fidelity High Dividend ETF $FDVV

FDVV has a dividend yield of 3.83% and has paid out $1.31 per share in the past year. The dividend is paid every three months.

TheFidelity High Dividend ETF avoids the…