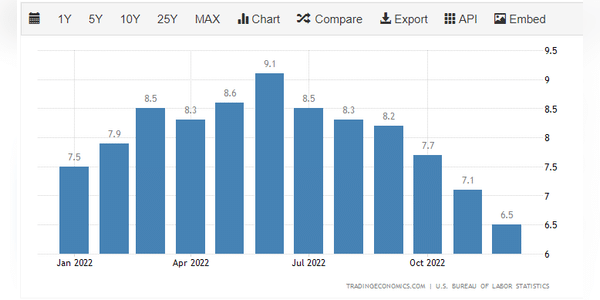

Don't rest on your laurels, warns a well-known expert. We are far from done with inflation

Inflation is easing. Investors are becoming more positive and coming up with better and better forecasts. But this leaves Larry Summers - a legend who thinks it's quite the opposite - completely cold.

Signs of weakening inflation and a few strong employment reports are not enough for Larry Summers to get positive. The economist and former Treasury Secretary worries that consumers are running out of cash, businesses are cutting costs and geopolitical uncertainty is on the rise. Combined with these risks, he warns that they could trigger a comical economic meltdown.

"I think we may reach a point where we get caught off guard by something we hadn't counted on at all. Sometime in the middle or second half of this year, it's going to be like walking on a ledge," Summers said Wednesday on television "I'm not predicting with certainty that it will happen, but I think the risks are significantly elevated."

The U.S. economy created 517,000…