Bill Combs

Zobrazit další komentáře

Not me :) You have it in your portfolio? I don't follow her much, but I know that usually a reduction in staff is more likely to be good news.

Zobrazit další komentáře

I don't have them either, and I've never thought about them. I think the chart says it all...

Zobrazit další komentáře

The purchase a few months ago is certainly at a very good price and the position will now be in the black. Nice company. Debt OK, dividend, growth on the horizon.

Zobrazit další komentáře

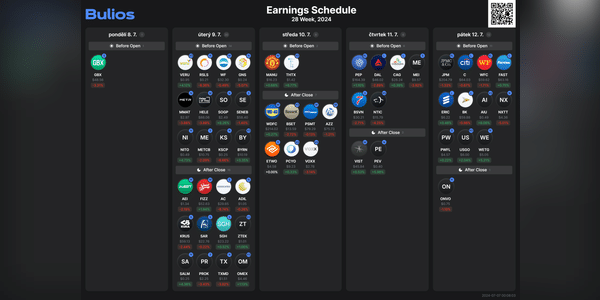

But this one got away, it was here a while ago and another quarter is already over :) Definitely the end of the week - banks.

Yesterday the US stock market rallied nicely and a lot of stocks hit their all-time highs. For example ,$GOOG, $AAPL, $MSFT, $NFLX and $META allhit their ATHs . I'm not currently buying much over the summer and rather holding, but I'm still riding DCA on $CSPX.L.

How do you currently approach stocks? Are you buying, holding or selling?

Zobrazit další komentáře

For now, it's more of a hold or sell. There will be buying, but when there is a lot more red on the chart.

Zobrazit další komentáře

I'm looking at the market very carefully right now. Most stocks are up and if there is a cooling of the big companies, it will be a chain reaction.

What do you think of $RIVNstock ?

For me an interesting company and the new cooperation with $VWA.BR is ha me great. Overall, I see quite a lot of potential in this company, but I haven't included their stock in my portfolio yet. If I ever do include them in the portfolio, it will be a small position.

Zobrazit další komentáře

I'm keeping a close eye on it. When the time comes, I'll buy shorts again :)

Zobrazit další komentáře

I'm not buying at the current price. But as a position complement, it's different and I understand that.

Zobrazit další komentáře

Luxury goods have shown really good resilience and growth in recent years. It's similar to LVMH. Both companies are doing very well. There was even (maybe still is) a collaboration with Apple on the Apple Watch.

What is your current perception of the tobacco industry?

I have $MO and $BTIstocks in my portfolio , but I'm selling BTI and keeping $MO. Revenues from regular cigarettes are down and will continue to decline, but companies are moving to e-cigarettes, new products and various alternatives that are becoming more popular and starting to sell more and more.

Zobrazit další komentáře

Shares of $CVS fell less than 4% yesterday, hitting52-week lows in the process . I have$CVS stock in my portfolio and it's a medium position, but I haven't overbought in a while and don't plan to. I am interested and will decide for me how the company will/will not do and whether the negative fundamentals will continue or improve.

Has anyone overbought during this downturn?

Zobrazit další komentáře

Unfortunately I'm in loss here too, I have an average buy here at 67$, I could be buying already, but the price was already lower so I'll wait, my position is also bigger but I believe that at least at 70$ they will look again.

I don't really like those car companies, but Stellantis is a pretty good company. Buying it might not be a bad choice.