Bill Combs

Zobrazit další komentáře

Shares of $WBD are still falling and I honestly don't know how to approach this stock. I have a small position as I see potential there and believe the company could do well, but on the other hand, I don't have much to back me up like stock trends, results or profitability.

How do you approach $WBDstock ?

Zobrazit další komentáře

I see it pretty pale here too, I'm just there on speculation and dilution because I bought stupid earlier and now I'm just hoping the price gets to $9 and running away from it.

Does anyone have $MDTstock in their portfolio ?

I was quite intrigued by Medtronic a couple of years ago as they are in an important sector, the business is nicely built and what they are doing makes sense to me long term and I can see the potential, but I'm interested in the opinion of others.

Zobrazit další komentáře

I don't know the company at all and overall this sector is quite complicated for me, although I would like to have a representative. So I wonder if anyone will know. According to the long term chart, it looks like it has found its bottom around $70 since falling from their highs and could be turning around. I don't know the numbers though, nothing, so I don't know ...😊

Zobrazit další komentáře

Collectivity is certainly interesting. The stock has sold off quite a bit over the past few years and has fallen below its fair value. Financially, the company is literally in great shape. Debt covers 2/3rds of its cash, so it still has $3 billion left, and it's still growing. Check it out and let me know if you're shopping :)

Zobrazit další komentáře

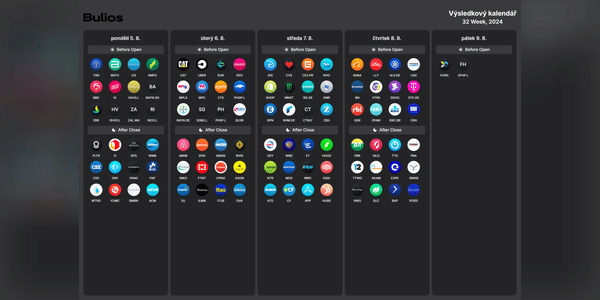

The drop came even after the company managed to achieve its highest earnings per share for the quarter. and matched the highest sales figure for the quarter. Investors were now expecting more from the markets, and in this earnings season, more than one stock got burned for the first time in a while. Well, for those of us who don't own this stock, it's an interesting opportunity. But at $40 it would be even better :)

Zobrazit další komentáře

Well, the results were, I would say, unexpectedly good. Good for shareholders. I followed the company about two years ago, but I didn't invest in it. Anyway, it's an interesting business.

Zobrazit další komentáře

The slump is very good for shopping. I have already established a base position and will be overbought.

Zobrazit další komentáře

I got a good price on Google, so I'm not buying yet. It's my biggest position, after all.

Zobrazit další komentáře

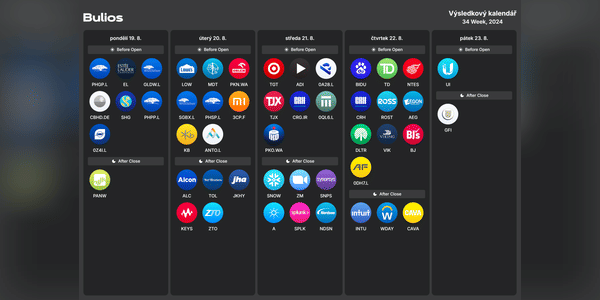

I think the results this week will be the last thing the markets will care about...:)

Zobrazit další komentáře

You caught it nicely. But the overall sentiment in the market is going to bring that appreciation down a lot today. The markets are down real solid today.

I don't have any energy stocks in my portfolio at the moment (except $CEZ.PR) and $CVX makes the most sense for me for now , as I want to hold it mainly for diversification and I'm not looking for mega big growth. The stock has been dropping quite a bit lately, so it's getting to a nice price.

What energy sector stocks are you currently buying?

Zobrazit další komentáře

Good dividend at finally a little lower price😁I'll buy more if the price drops further.

Zobrazit další komentáře

It's a classic and luxury will always be bought, but... CHINA... we have become too dependent on it and the comrades are haunted... Enough with the western decadence... You will drink the Rice brandy... Cognac is anti-human.

Zobrazit další komentáře

Google is my biggest position. I shopped for really very decent values, so the answer ba question is: deep😅

I'm curious about $TGT and then how the construction sector will do, I'd quite like to find a company at an interesting price if it's not too late, because with the gradual lowering of rates and next year, there could be more building again thanks to cheaper money.