Index Investing: the safest investment strategy

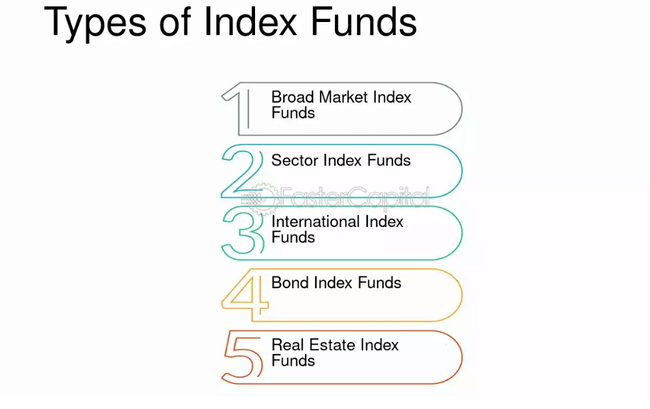

Investing in index funds is one of the simplest and most effective ways for investors to build their wealth. These funds track the performance of a specific market index, allowing investors to achieve returns that match the performance of the entire market or a specific part of it.

In this article, you'll learn how index funds work, how to choose the right one for your needs, and the advantages and disadvantages of this type of investing.

What is an index fund?

An index fund is an investment vehicle that tracks the performance of a specific market index, typically made up of stocks or bonds. These funds typically invest in all the components of the index they track and their managers ensure that the performance of the fund matches the performance of the index itself. Investing in index funds is popular for its simplicity and efficiency, as it does not require in-depth knowledge of the stock market.

How to invest in index funds?

Selecting an index - The first step is to select an appropriate…