Both Lemonade $LMND, and SoFi $SOFI Technologies are innovative companies looking to enter the insurance and banking markets. Although they have the potential to truly change the market, their stocks have fallen significantly from their all-time highs, even after experiencing huge price increases since the beginning of May. Currently, both stocks are "waking up" and may hold great opportunities for investors.

Lemonade was founded in 2015 to innovate and change the way the traditional insurance industry operates. Lemonade uses artificial intelligence and automated processes to make insurance management fast and convenient.

Their main product is home and condo rental insurance, which offers a simple and transparent way to arrange and manage insurance.

In recent months, there has been no hotter topic in the world of business and technology than artificial intelligence. Investors are moving quickly to try and identify stocks that are riding this wave. Lemonade has long been incorporating AI into their operations, and their models are based on AI.

1. Lemonade $LMND

By leveraging data, technology, andAI, Lemonade is able to approve new policies in as little as 90 seconds while approving and paying out amounts in as little as three minutes.

This direct-to-consumer setup is in direct contrast to the traditional insurance model, which relies on an army of salespeople and physical offices scattered across the country, slowing things down due to legacy systems.

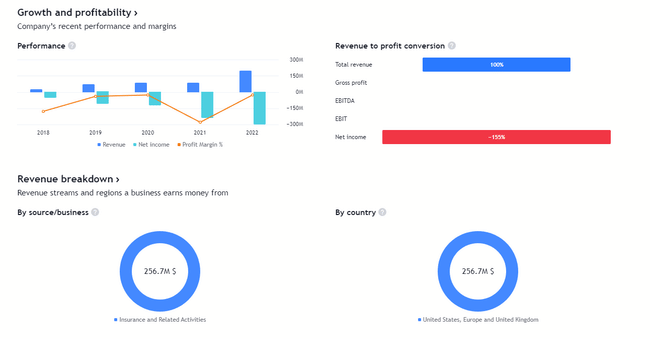

Lemonade's first digital model hasn't yet produced any profits, but the growth has been extraordinary. The business ended the first quarter with 1.9 million customers, up 23% year-over-year. Revenues were up 115% and in-force premiums were up 56% compared to Q1 2022.

The fact that all three of these metrics continue to grow rapidly, especially as many companies are seeing a slowdown in growth, is a positive sign.

The company offers several insurance products, renters, homeowners, auto, pet and life.

The key to Lemonade's strategy is to attract younger consumers who buy more products over time. The company reports that less than 4% of its customers have multiple products, but for existing insurers, that number is 60%. This represents a huge opportunity for future growth.

2. SoFi $SOFI

Sofi was founded in 2011 as an online platform for student loan refinancing. Since then, it has grown into a broad-based financial platform.

Sofi offers a variety of financial services, including student loan refinancing, personal loans, mortgage loans, investment services, savings accounts, credit cards, and other banking products.

Another popular, though rather negative, topic on investors' minds in 2023 is the regional banking crisis. As the Federal Reserve raised interest rates at the fastest pace in history in 2022, some financial institutions saw the book value of many of the loans they held drop, prompting regulatory action. In the midst of this turmoil, SoFi shines brightly.

About 98% of SoFi's loan portfolio (as of March 31) consisted of student loans and personal loans, which are much less affected by interest rate changes, unlike long-term Treasuries, because they have shorter maturities.

This allows SoFi to better price its loan products to match Fed policy.

Additionally, the digital bank has seen its deposits grow from $7.3 billion at the end of 2022 to $10.1 billion at the end of March 31. Operating an online-only model makes it incredibly seamless for customers to move their money to SoFi.

The company has also expanded its FDIC insurance options from $250,000 in deposits to $2 million, allowing customers to see the security in moving their money to SoFi.

As with Lemonade, SoFi's growth has been remarkable. Its customer base, called "members," grew 46% year-over-year in the first quarter. And adjusted net income was up 43%. Management is optimistic, having raised its full-year adjusted revenue guidance to between 27% and 31% growth.

Despite the fact that both companies are still losing money for now, they are struggling and have great products. These can help them replace at least some of the "old banking" in the future and take it a step further again. Anything using AI makes even more sense in these industry-centric times.

This is not about financial advice. I am providing publicly available data and sharing my views on how I would handle the situations myself. Investing is risky and everyone is responsible for their decisions.