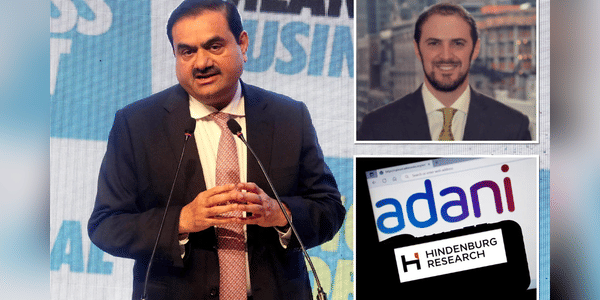

How did Hindenburg's bet against Gautam Adani's Indian empire turn out?

In January 2023, Hindenburg Research published a report accusing Gautam Adani and his vast business empire of fraud going back decades. The consequences were immediate and devastating: the value of his companies plunged by more than $100 billion. What does the situation look like now?

Eighteen months on, Adani, who denies any wrongdoing, has recovered from much of the assault. A small American short seller, Hindenburg, revealed how much he made on a bet against the Indian billionaire: just over $4 million.

That amount, disclosed for the first time by Hindenburg, was published by the firm on its website on Monday, along with details of a letter it allegedly received from India's markets regulator.

According to the New York firm, the Securities and Exchange Board of India (SEBI) accused Hindenburg's report on Adani of making inaccurate statements that were intended to "mislead the reader". CNN has asked both SEBI and the Adani Group for comment.

Hindenburg said in a statement that this was …