Three data center stocks worth knowing

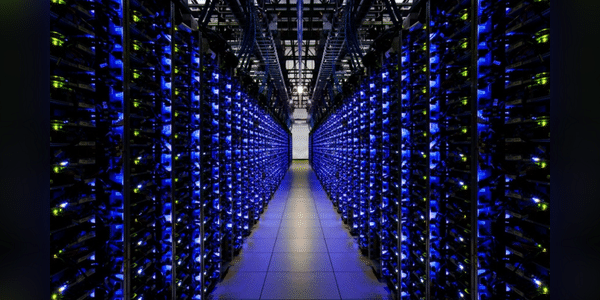

In recent years, artificial intelligence (AI) has become one of the hottest market themes. Investors are constantly looking for ways to gain exposure to this dynamic sector. One of the most interesting approaches is to focus on stocks of companies that are key players in the data center space.

Data centres form the backbone of modern digital infrastructure and their importance is growing steadily in an era of AI expansion. In this article, we look at three stocks that may be of interest to investors.

Vertiv $VRT

Vertiv provides services for data centers, communications networks, and commercial and industrial facilities. It offers a broad portfolio of solutions and services focused on power, cooling and IT infrastructure. The significant increase in revenue and earnings outlook indicates that demand for Vertiv's products continues to grow.

Despite the stock's low annual yield of 0.1%, the company has been able to generate cash, giving it flexibility for future dividend increases. In the…