As such, hydrogen has enormous potential. This low-carbon fuel could help address climate change concerns while meeting the world's growing energy needs. While estimates vary, Deloitte believes the market for green hydrogen could reach $1.4 trillion by 2050. This is just the tip of the imaginary iceberg. The potential size of the market for low-carbon molecules could reach $6 trillion by 2050.

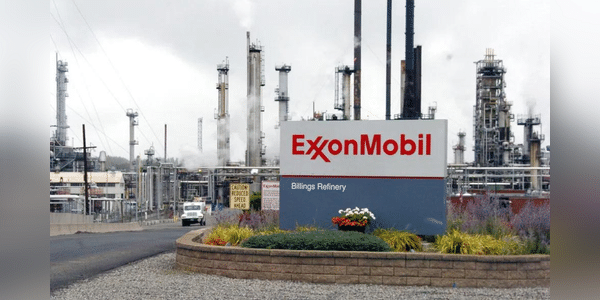

ExxonMobil $XOM wants a share of this huge market opportunity. The oil giant is currently working to develop the world's largest low-carbon hydrogen project. This is one of several steps the oil company is taking to tap into the potentially lucrative demand for low-carbon energy.

Partnership on groundbreaking hydrogen project

ExxonMobil recently announced that Air Liquide is joining its low-carbon hydrogen and ammonia project at its facility in Baytown, Texas. The agreement will allow Exxon to transport low-carbon hydrogen through Air Liquide's existing pipeline network. In addition, Air Liquide…