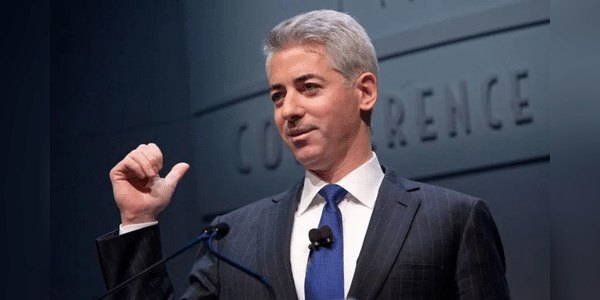

Bill Ackman, one of the most well-known billionaire investors, is known for his aggressive investment style and ability to make huge profits. However, he recently failed to launch a publicly traded hedge fund, raising questions about his future direction. Yet his investments can still be tracked through his hedge fund, Pershing Square Capital Management, which regularly publishes its portfolio.

Ackman's investment strategy is concentrated - he currently has about 60% of his portfolio invested in three main companies. Here are his biggest current bets:

Alphabet $GOOG (22.1%)

Ackman's largest investment is tech giant Alphabet, the parent company of Google. Ackman began buying Alphabet stock at a time when many investors were concerned about the impact of artificial intelligence on Google's core business. However, AI has proven to be a big opportunity for Alphabet, as reflected in the growth of both Google Cloud and core search revenue. Despite some weakness in YouTube ad revenue growth,…