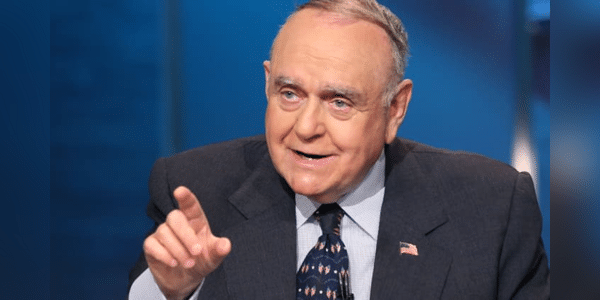

Leon Cooperman is a name most Wall Street investors remember well. This legendary investor, who began his career at Goldman Sachs where he headed asset management, has gradually built a strong presence in the investment world. In 1991, he founded his own hedge fund, Omega Advisors, which has been a long-term success. However, Cooperman decided to close the fund in 2018 and donate most of his assets to charity. Still, his investment decisions continue to attract the attention of many investors.

Recently, he has expressed concerns about the U.S. economy and high interest rates, which he sees as a risk to short-term growth. He considers most market opportunities to be overvalued, which forces him to be cautious in his investments.

In this article, therefore, we look at three of Cooperman's main investment bets that should not escape the attention of any value investor.

Mr. Cooper Group $COOP

Mr. Cooper is one of the largest non-bank mortgage service providers in the US. This stock has seen…