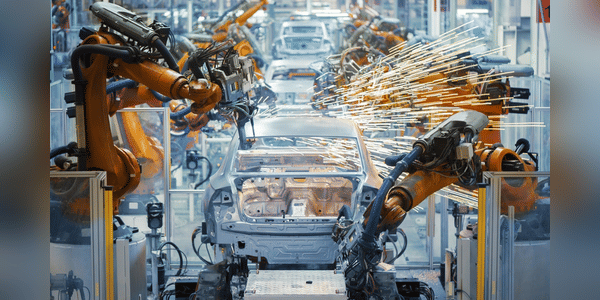

In an automotive industry that is undergoing a significant transformation towards electric vehicles and autonomous driving, a company is emerging whose strong global presence and more than 340 production sites make it a major player in the market. The company manufactures key components for both traditional and electric vehicles and works with leading automakers such as BMW, General Motors and Ford to ensure the supply of quality parts.

Investing in this company is proving attractive due to its stable dividend payout and solid growth. With a current dividend yield of 4.33% and an average annual dividend growth rate of 6.40% over the past three years, it offers an attractive opportunity for investors looking for a combination of stability and potential for future appreciation. In the following paragraphs, we look at the company's key metrics and plans for future growth that make this an interesting investment in the context of a rapidly changing automotive sector.

Company introduction

Magn…