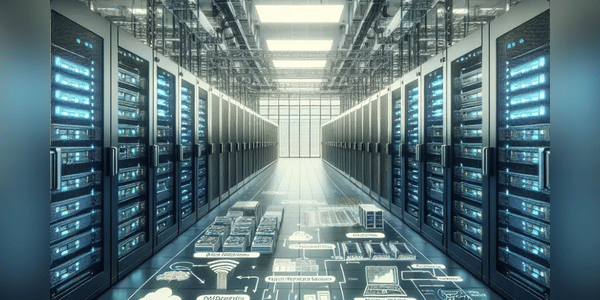

In recent years, investment in data centres has become a key topic, especially in the context of growing demand for cloud services and artificial intelligence technologies. The four largest companies - Microsoft, Amazon, Alphabet and Meta - are expected to increase their capital spending on data centres by 40% year-on-year by 2025.

This expansion will benefit not only the hyperscalers themselves, but also the companies that provide the necessary infrastructure for data centres. In this article, we look at three stocks that stand to benefit from this trend.

Arista Networks: the leader in cloud networking solutions

Arista Networks $ANET profiles as a leading provider of cloud networking solutions and has a significant share of the Data Center Interconnect (DCI) market. With rising capital expenditure on data centers, the company is expected to increase sales of its Ethernet switches, routers and software solutions. Microsoft and Meta Platforms, which account for 39% of its total revenue,…