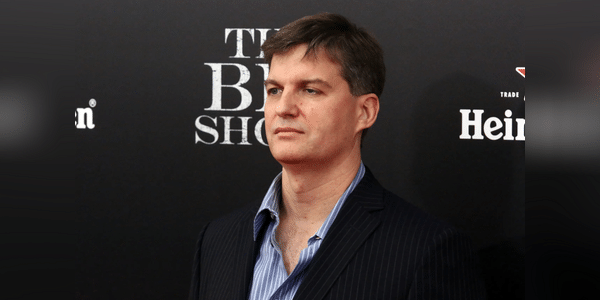

Michael Burry and his investment in three stocks with great potential

Michael Burry continues to buy shares of Chinese technology companies. The move has attracted attention not only among investment experts but also the general public, who are asking what is behind his decision at a time when relations between the US and China are not at all rosy.

Burry, founder of the Scion Asset Management fund, has decided to increase his positions in several Chinese tech giants in recent months. What are the 3 companies in question?

JD.com $JD: E-commerce leader with big potential

JD.com is one of the biggest players in the Chinese e-commerce field, competing with such giants as Alibaba. The company not only focuses on online sales, but also on logistics, which makes it unique compared to other online marketplaces. JD.com has invested heavily in its own delivery network in recent years, allowing it to provide fast and efficient delivery even in less developed areas of China. This growth in logistics can bring huge benefits to the company in the long term, as e…