There have been some interesting things happening in the cybersecurity space in the last quarter, particularly in relation to CrowdStrike. Although its revenue was up 25%, the company's stock saw a decline, raising questions about its future prospects. What's behind this? And what steps is the company taking to meet the challenges of the market?

What's happening?

CrowdStrike $CRWD is currently in a period of transition, facing significant challenges despite solid revenue growth. The company is dealing with a negative market reaction to its lower-than-expected earnings, which has led to a decline in the stock. Despite this downturn, CrowdStrike maintains a strong position in the cybersecurity space thanks to growing recurring revenue and acquisitions that expand its cloud protection capabilities. Added to this is a newly introduced flexible subscription model to encourage wider adoption of its platform.

How was the last quarter?

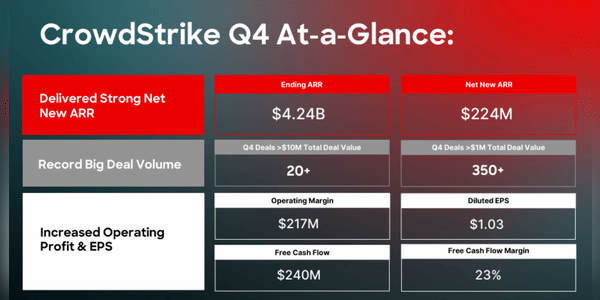

The company reported revenue of $1.06 billion in the most…