Artificial intelligence has rewritten stock market history. Nvidia has become the symbol of an entire era and has crossed a threshold that seemed impossible just a few years ago. What factors were behind this historic moment and what does it mean for investors?

When market capitalisation ceases to have limits

Just a few years ago, Apple and Microsoft dominated the technology charts. But today, a new giant is taking the lead, and its growth will define an entire decade of investing. Nvidia $NVDA has become the first company in history to surpass the $5 trillion market capitalisation mark.

This moment is not only symbolic of the strength of the AI trend, but also proof that the investment paradigm has fundamentally shifted. Nvidia has become the backbone of digital infrastructure - just as Microsoft $MSFTwas once the backbone of personal computing.

What triggered further growth

On Wednesday, Nvidia shares rose as much as 4.6% after the market opened, pushing the company past a key threshold. The market sentiment was boosted by a combination of two factors:

- Optimism around deals in China.where President Trump has hinted at a possible approval for the export of Blackwell chips,

- a a wave of positive news from the GTC technology conference in Washington, D.C.where Nvidia announced a number of strategic partnerships and new projects.

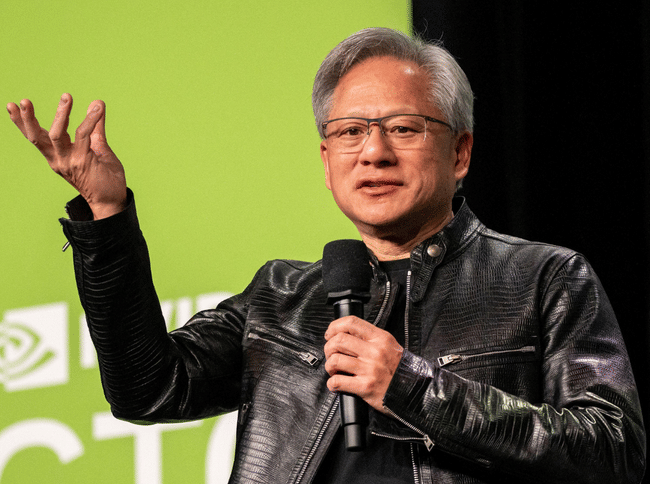

Trump mentioned that he was going to personally discuss with CEO Jensen Huang about "Blackwells" - a new generation of AI chips that could get an exemption for export to China. This would open up a huge market that has been closed due to sanctions.

GTC: where Nvidia sets the pace of innovation

At the GTC conference, the company unveiled an entire ecosystem of partnerships that ranges from government institutions to pharmaceutical and telecom giants:

- Collaboration with the U.S. Department of Energy to build seven supercomputers, one of which will use 10,000 Blackwell GPUs.

- An alliance with Uber to develop a fleet of autonomous vehicles.

- Supplying 1,000 GPUs to pharmaceutical leader Eli Lilly to accelerate drug development.

- Collaborations with Nokia, Cisco and T-Mobile to develop 6G technology.

- New NVQLink open architectureto accelerate the development of quantum supercomputing in collaboration with Rigetti and IonQ.

- Connections to giants such as Amazon, Google, Microsoft, Meta and Oraclewho are massively buying chips for their data centre projects.

Huang said during the presentation that expects $500 billion in GPU sales by the end of 2026, with the company already surpassing $100 billion in sales in the first two quarters this year.

Competition intensifies, but Nvidia still dominates

The first serious rivals are on the horizon. AMD $AMD has struck a deal with OpenAI to supply up to 6 gigawatts of computing power and a separate deal with Oracle for 50,000 GPUs.

Qualcomm $QCOM, meanwhile, announced its entry into the datacenter AI segment with its own accelerators.

What's more, Nvidia's own customers (Amazon, Google, Microsoft) are developing their own chips.

Still, Nvidia maintains a unique position through a combination of performance, the CUDA software ecosystem, and years of optimizing the entire development environment for AI applications. For investors, this means that despite growing competition, the company still has the highest "moat" in the industry.

Market psychology: from bubble to infrastructure

Many investors are starting to liken Nvidia to the "new Microsoft" - not because it's the next tech bubble, but because it's becoming the infrastructure standard.

AI is no longer a fad, but an industry transformation with huge capital expenditures. Investors are building data centres, companies are developing new models, countries are setting up AI initiatives. And at the center of it all is Nvidia hardware.

The risks: unrealistic expectations and geopolitics

But there are also warning signs hanging over the market.

- Extreme valuations - At its current capitalization of $5 trillion, the company's P/E is historically high.

- Dependence on US-China relations - Any deterioration in the political situation could derail export plans.

- Technological saturation - If the pace of AI adoption growth slows, the entire segment may be reassessed.

Thus, it makes sense for investors to combine a position in Nvidia with diversification into other AI infrastructure players or semiconductor-focused ETFs.

Summary

Nvidia has reaffirmed that it is not only a leader in the current technology revolution, but also a symbol of a new era of capitalism dominated by data and computing power.

The historic breakthrough of over $5 trillion shows that AI is not hype - it is a new economic ecosystem.

"Nvidia is not just a chip company. It's the infrastructure of a new digital civilization." - Jensen Huang, CEO

Key points for investors

- Nvidia has surpassed $5 trillion in market capitalization - a first in history.

- Trump's comments about possibly exporting Blackwell chips to China were a key boost.

- GTC brought new partnerships with Uber, Eli Lilly, DOE, Nokia, Palantir, Oracle and others.

- The company expects $500 billion in GPU revenue by the end of 2026.

- Risks: geopolitics, valuation, slowing AI investment.