As long-term government bond yields keep climbing, a foundational component of financial markets is recalibrating — and equity investors cannot afford to ignore it. The bond market, often perceived as the quiet backroom of capital flows, is now loudly signalling that the favourable low-interest-rate era may be fading. For stock markets, this means the runway for easy gains is narrowing, and a new phase of selective, disciplined investing is underway.

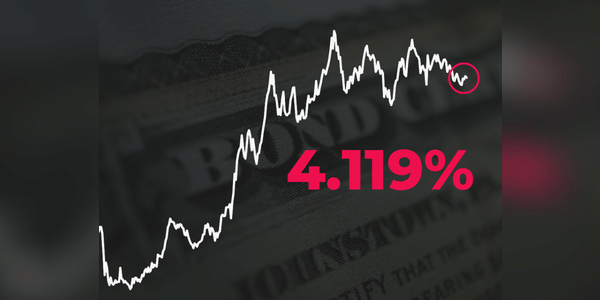

The evolution of the 10-year US Treasury note from 2020

For several years, we have seen an environment of extremely low interest rates, with long-term government bond yields (10-year or 30-year) at very low levels. This environment has been very favourable for equities. But now that time seems to have passed. Yields on these bonds are rising again. Current analyses show that long-term yields do not anticipate further sharp rate cuts by the Fed, but respond to a broader range of factors.

How the bond market works

The government bond market is…