The United States has entered a new fiscal frontier—its federal debt servicing costs for 2024 soared to around $881 billion, eclipsing the defense budget and accounting for roughly 13% of all federal spending. With public-financing pressures mounting and interest rates still elevated, the question isn’t just how high the debt is, but how quickly it’s growing. In this article, we explore why the fiscal burden America carries today could become a structural drag on economic growth, how it may ripple through stock and bond markets and what investors need to watch if the world’s largest economy begins to buckle under its own weight.

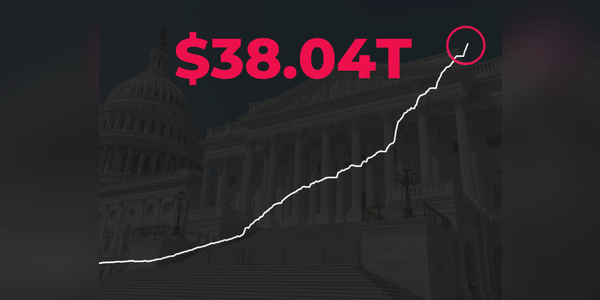

Chart of rising US government debt since 1999

The United States is now running deficits in excess of what would have been considered an extreme just a few years ago. Moreover, at the current level of interest rates, the cost of servicing the debt is rising at a record pace. It is already one of the largest items of expenditure in the federal budget. Interest…