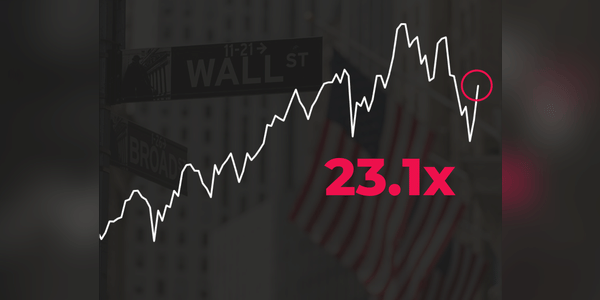

The forward price-to-earnings ratio for the S&P 500 has climbed into territory seen only a handful of times in the past decade—raising a fundamental question for markets: are stocks truly justified at these lofty valuations, or is the optimism baked into prices running ahead of economic reality? With earnings growth decelerating, interest rates remaining elevated and concentration in just a few mega-cap names at record levels, investors should not ignore the warning signs embedded in today’s elevated forward P/E. While this alone doesn’t mean an imminent crash, history shows that entering extended periods of high valuation often precedes lower long-term returns and higher volatility.

The link to the macroeconomic environment is crucial. After the pandemic, we experienced a period of extremely low interest rates and cheap money. In such an environment, companies grew record margins, investment grew and many investors put money into risky assets, i.e. equities. As a result, expected…