Although a 16 % increase for the S&P 500 in 2025 may look attractive at first glance, for such a broad and deep market benchmark it actually ranks as below-average performance compared with historical cycles. With valuations elevated and many investors expecting a breakout year, the modest rally shows how much of the earlier upside has likely already been priced in. Meanwhile, other global markets — including those outside the U.S. — are posting stronger returns, prompting a growing debate: is 2025 a year of complacency for U.S. equities rather than a bull-market surge?

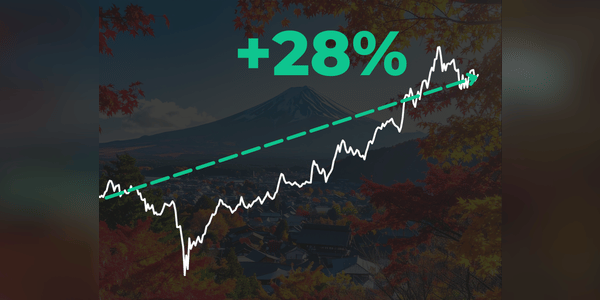

The performance of the Nikkei 225 index since the beginning of 2025

Comparison of the S&P 500 and Nikkei indices

Looking at this year purely through the lens of index performance, the numbers are relentless. Goldman Sachs in November report cites data showing that the Nikkei is up roughly 30% in dollar terms, while the S&P 500 is up "only" 14% (the US index is up 2% today). Further analysis add that 2025 is generally the…