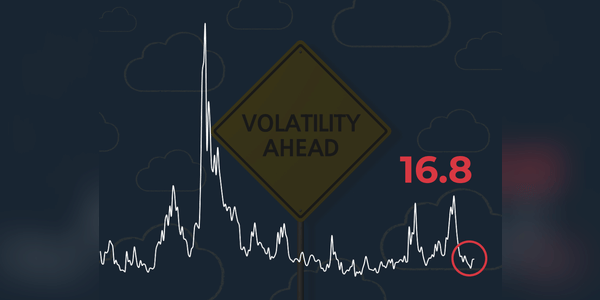

Wall Street seems calm, volatility is at multi-year lows, and the S&P 500 continues to rally. But market history teaches us one thing: extremely low VIX levels often come before sharp corrections. Is this serenity a sign of strength — or just the calm before a storm?

How the VIX works

The VIX volatility index, often dubbed the fear index, measures the expected volatility of the S&P 500 stock index over the next 30 days. It is calculated from the prices of option contracts on the S&P 500 index, and therefore reflects the degree of fear or uncertainty investors have about the future direction of the market. Typically, the VIX has an inverse relationship with the S&P 500 Index.

When stocks fall sharply and fear grows among investors, VIX values rise, and conversely, when stocks rise, VIX values fall. In other words, increased volatility and nervousness in the markets will result in a higher VIX, while a calm, stable period means a low VIX. In practice, therefore, VIX levels are often…