Buybacks vs dividends. Which is more profitable for shareholders?

As a shareholder, you want to be rewarded in some way by the company you own. Companies use two mechanisms to do this, buybacks of their own shares (buybacks) and a certain amount of money (dividends). There is a constant debate among investors as to which is actually better. This will also be the topic of my article.

The first thing to remember is that companies have defacto only three ways to dispose of free capital. The first way is to invest in themselves. This means investing, for example, in technology, production processes, etc. This is how growth stocks are commonly recognized. The second way means buybacks and the last way is dividends. This is mainly done by value stocks.

Buybacks

A buyback, if you like, is done by a company that thinks its stock is undervalued. This is nothing more than the company buying its own shares to reduce their number, the repurchased shares are sort of wiped out. Reduction in number = increase in market price. That should be the basic effect.

What are the effects of buybacks?

- Increase the ownership of the shareholders who still hold those shares

- Increase market value - important effect, the firm thinks their share price is actually higher than the market values it

- Taxsavings - I would like to elaborate on this point

When the market price increases due to a buyback, you may realize a profit that would not have happened under normal conditions without the reduction in the number of shares outstanding. This is advantageous for both you and the company, as the company has not had to tax this at all so far. You also did not have to pay any tax when you realised the gain under certain conditions.

But that changes a bit now in August, because the US is introducing a 1% tax on buybacks as part of the anti-inflation law. It is possible that this will result in companies moving slightly away from share buybacks and resorting more to dividends.

- Improvements in various metrics

When the price increases , earnings per share (EPS) increases, hence price to earnings ratio (PE ratio) decreases. These metrics are quite important. Simply put, you want the largest EPS and the smallest PE.

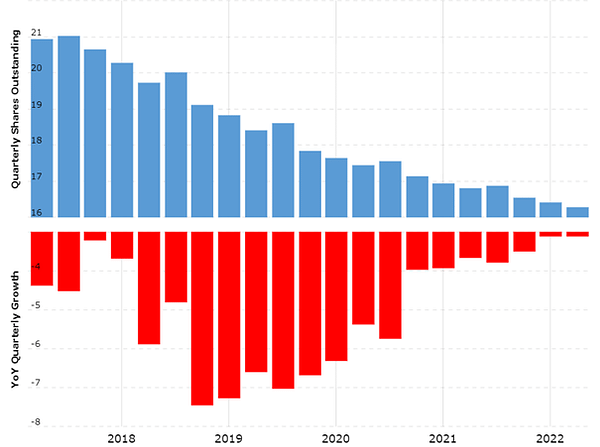

Let's use the example of Apple to show what buybacks look like in action.

As we can see in the charts, there is indeed a certain parallel between the decrease in the total number of shares and their price.

Dividend

By definition, a dividend is the distribution of a company's profits to its shareholders and is set by the company's board of directors. Most commonly, a dividend is paid quarterly, but often it is paid monthly.

There is a term associated with a dividend, but also dates. A popular number is the dividend ratio, which is nothing more than the ratio of the dividend paid to the share price. The payout ratio, in turn, is the proportion of profits a company pays out to its shareholders, expressed as a percentage of the company's total profits. Anncouncement day is the day on which the company's management announces the dividend amount. I would also single out Ex-dividend day, which is the date when the right to receive dividends ceases. So if you buy a stock on this day or later, you will no longer be paid a dividend for that quarter.

The dividend is very popular, especially from a psychological point of view. You get a regular amount of money coming in and you're creating some kind of passive income, which is just great. The downside is that you have to invest quite a bit of money to get any reasonable amount of money out of it. But the bigger problem is the tax disadvantage. When you get paid out, your broker automatically withholds 15% of the dividends because of withholding tax. In a worse case, it can be as much as 30% if there is double taxation. I wrote an article about this issue concerning brokers some time ago.

Summary

In general, it is fair to say that buybacks are better for shareholders, they are not tax disadvantaged in any way, or at least they were. And the question is whether the 1% tax will be followed by more and more taxation.

Personally, I think a mix of both buybacks and dividends is a good option. It depends on the individual stock, every company is a little different. For example, the thesis that the bigger the dividend the better is complete nonsense.

What about you, how much emphasis do you put on whether a company is making buybacks? What's your opinion on the 1% tax? Or do you prefer regular dividend payments? 🤔

nice info

kanda ahh