Feed

Broadcom reported great results yesterday. Revenues were up 20% year-on-year and other items also grew solidly. The stock has rallied recently and the current valuation is already quite high. I've had $AVGOstock in my portfolio for a few months now and I'm very happy so far.

Do you also have $AVGOstock in your portfolio?

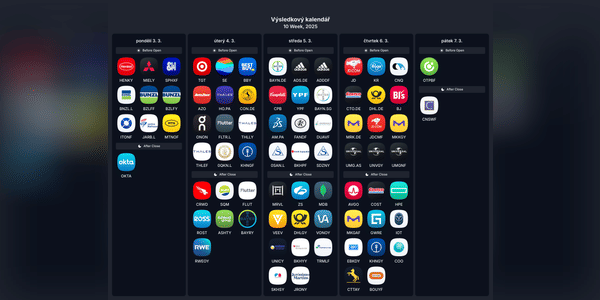

📅 This week's key events!

After a week's break, I'm back with a round-up of highlights for the week ahead. The results season is coming to the very end, so this week is weaker in terms of results. Still, we have some important macroeconomic signals and reverberations of geopolitical issues.

🟠 Monday

Market reaction to Trump's tariffs.

ISM Manufacturing PMI - The data will give a...

Read more

Zobrazit další komentáře

The employment report will be important and there may be some interesting results this week.

🔌Technology sector under pressure: Nvidia and AMD warn, the whole sector reacts with a sell-off!

Tensions between the US and China are once again rocking the technology market. Chipmakers are reporting higher costs and regulatory uncertainty that is starting to weigh heavily on company results and outlooks.

The most visible case is the company Nvidiawhich has announced that it...

Read more

Zobrazit další komentáře

It's not good news for these two companies, but it doesn't change my opinion and I think AMD is a great company with a lot of potential.

Zobrazit další komentáře

Broadcom reported very solid results yesterday, beating expectations. Shares of $AVGO subsequently rose 12% in the aftermarket. I'm buying now on the dips, so we'll see if the rise continues or if this is just a short-term reaction.

What do you think of Broadcom's results? Do you have shares of $AVGO in your portfolio?

Zobrazit další komentáře

Broadcom shares are still falling. They're down about 19% this year alone and are writing off 6% so far this week. The company reports earnings tomorrow, so we'll see how that affects the share price. I think the current valuation is already quite interesting and I'm gradually overbought.

Are you buying $AVGOstock on this pullback or are you waiting for better prices?

Zobrazit další komentáře

The drop is already quite big, al from this sector I have so far only bought $AMD.

🗓️Týdenní an overview of key events in the markets!

This week will bring important macro data, key earnings reports and key comments on monetary policy. Also important will be an announcement from Donald Trump, US employment data and a speech from Fed Chair Powell.

Monday

🛠 ISM Manufacturing PMI - the state of industrial activity in the US

🚗 Results before the markets: Continental ...

Read more

Zobrazit další komentáře

Zobrazit další komentáře

🚀 Microsoft and the AI revolution: what does $80 billion mean for the future of technology? 💡

Microsoft $MSFT recently announced that it plans $80 billion in data center and AI investments for 2025. That's almost double the $44 billion last year ! This massive investment confirms that tech giants will continue to aggressively push the development of AI and related industries.

...

Read more

Zobrazit další komentáře

I honestly trust Google more, as I think they have more potential, but this news is great. Microsoft is really doing well and can simply afford such investments.

I started buying shares at the beginning of the year and have been in solid profit since then and the results have been good too.