Many newcomers may not address this issue and trust the exchanges, keeping their cryptocurrencies on the exchange believing they are safe. A brief look at the history of Bitcoin and cryptocurrencies will reveal why it is dangerous to leave your cryptocurrencies on an exchange, and we will also highlight options for safe cryptocurrency storage.

Alternatives to safe cryptocurrency storage.

Billions of dollars worth of assets have been stolen from exchanges since Bitcoin's inception in 2009, and these numbers are increasing year on year. Of course it depends on the strategy you are running, if you are an investor who does a lot of trade trades on a daily basis, then it is clear that it is most comfortable to hold cryptocurrencies on an exchange. However, there are some types of investors who are focused on long-term investments, which is what I am personally, and for us the best alternative is to store cryptocurrencies safely as we don't plan on selling anytime soon.

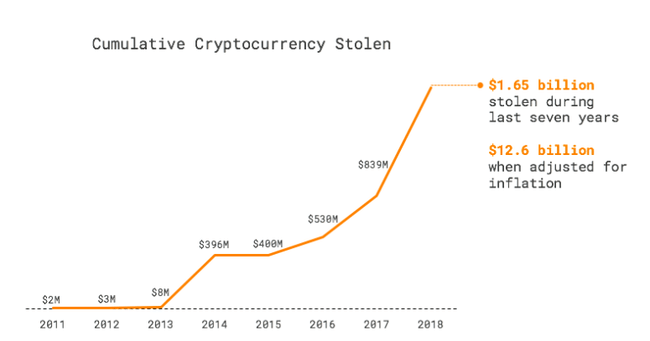

Just to give you an idea, you can see in the following chart the upward trend of hacks, which started to increase rapidly from around 2013 and will undoubtedly continue to increase.

We can see a cumulative stolen cryptocurrency volume of 12.6 billion, a figure only up to 2018, and certainly none of us doubt that the current figure in 2022 is significantly higher. This should be a reason to consider if you want to invest or are investing for the long term.

However, this risk may not just be related to hacks; risks and problems can also come from the stock exchange itself. An example of this is the well-known event of the death of the CEO - QuadricaCX, who reportedly died and failed to access nearly $200 million worth of access and accounts. Or you may have heard of the famous Mt. Gox exchange, whose founders were oblivious to the ongoing hacks that lasted over two years, with the exchange losing 650,000 BTC and only managing to find a portion of about 140-150,000 BTC.

Facts worth considering

- Exchanges are not cybersecurity businesses, at least not the lesser known ones. They are the first to operate financial markets and experience has shown that they cannot guarantee top-notch security.

- Exchanges lose an average of $3 million every day, and that number will increase in the future.

- Hacker attacks are becoming more and more complicated. It is a highly rewarding activity and therefore hackers are spending more and more time and resources planning these attacks.

But if you want to have cryptocurrencies stored on an exchange, even after this information, be sure to open an account on the most well-known platforms that should have the highest level of protection possible, for example: Binance or KuCoin. There is no guarantee that you won't fall victim to another known hack, but choosing a reputable and highly secure exchange greatly reduces your chances.

The hallmarks of a secure exchange

- The best and most reliable platforms are open about the level of security they provide and give you a number of tools to secure your account. Slowly, email or phone number authentication with a combination of 2FA Authenticator is already a must.

- Secure exchanges have a valid HTTPS certificate. Your browser will automatically confirm this by displaying a lock in the address bar. HTTPS is an encrypted version of HTTP. It prevents interception and modification of the data you send to the web server. Every reputable cryptocurrency exchange should have it.

Representation of a valid HTTPS certificate .

- Requiring a strong password, unless the exchange requires combinations of lower case, upper case letters combined with numbers and special characters - this can raise suspicion as to whether the exchange really cares about protecting its clients.

- Two-Factor Authentication 2FA - As I mentioned earlier, it is important that your exchange requires 2FA. Most exchanges offer multiple 2FA methods including software, SMS and hardware devices. If there is no option to secure your account using 2FA, the platform is pretty insecure. Hackers can also spoof your phone number, so the weakest form of 2FA is SMS verification. The most common practice is to set up two-factor authentication through Google Authenticator. It's a simple but secure and effective approach.

- Cold Storage - Check if the exchange uses cold storage to store user credentials. It is much harder to steal resources that are locked offline.

- Other precautions are certainly useful as well. Exchanges use many other security tools such as multiple signatures, suspicious behavior alerts, email encryption, phishing protection and more.

- Insurance at this time is more of a marketing tool in the hands of exchanges than a functional feature because most of these policies do not protect individual accounts and only cover the exchange as a whole.

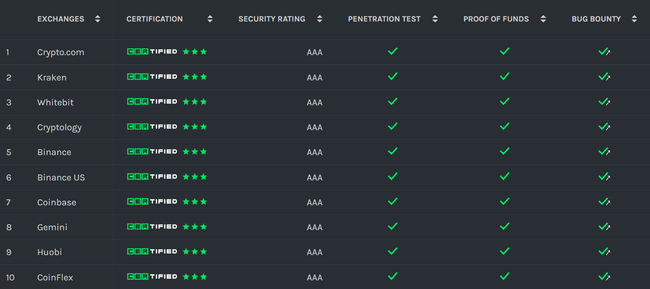

The safest exchanges by rating

These 10 exchanges have AAA ratings.

Crypto.com, Kraken, Binance, CoinBase...

Regardless of all the security measures the exchanges use, it is still naive to trust them implicitly. As the history of exchanges shows, no platform is immune to hacking and problems will always occur when you least expect them. That's why it's better to take matters into your own hands and create a private digital wallet. As renowned cryptanalyst and security entrepreneur Andreas Antonopoulos says:

Your keys, your Bitcoin. Not your keys, not your Bitcoin.

Secure cryptocurrency storage

Buying cryptocurrency is one thing, while storing it securely requires a completely different set of skills and knowledge. To manage your crypto assets and keep them safe, you need to have a cryptocurrency wallet.

Crypto Wallet

A cryptocurrency wallet is a software program designed to store your public and private keys, send and receive digital currencies, track their balance, and interact with various blockchains.

There are many cryptocurrency wallets, but the fundamental difference between them is whether they are hot or cold wallets. The difference between the two?

- Ahot wallet is connected to the internet and can be accessed at any time.

- Cold wallet is not connected to the internet and allows you to store your funds offline. You can still receive funds at any time, but no one can transfer them.

Most cryptocurrency holders use both cold and hot wallets. Hot wallets are handy for frequent trading, while cold wallets are better for holding crypto assets long-term. Therefore, it depends on your strategy, so if you want to hold crypto for months or years then it is definitely better to have a cold wallet.

https://www.youtube.com/watch?v=Z0sYP1kg-zk&ab_channel=CRYPTOHEADZ

- Cloud wallets - with this wallet you can access your funds from any computer, device or location. They are super convenient but store your private keys online and can be controlled by third parties. This makes them more susceptible to attacks and theft. Metamask is being used.

Software wallets

Software wallets are downloaded and installed on a personal computer or smartphone. They are hot wallets. Both desktop and mobile wallets offer a high level of security, but they cannot protect you from hackers and viruses, so you should try to stay malware-free. Exploited are Jaxx, which I personally have, or Exodus.

Hardware wallets

Unlike software wallets, hardware wallets store your private keys on an external device such as a USB. It's a type of cold wallet and provides the most security in my opinion. They are also able to make online payments. Some hardware wallets are compatible with web interfaces and support multiple currencies. They are designed to make transactions easy and convenient, so all you have to do is connect it to any online device, unlock the wallet, send the currency and confirm the transaction. The only downside is that you have to physically buy them, but that's not such a disadvantage as they provide you with a high level of security. The most used types include Trezor and Ledger.

Keep in mind that not all multi-currency wallets support all coins. Even hardware wallets have a limited amount of coins they support.

https://www.youtube.com/watch?v=aPprQUQljHE&ab_channel=99Bitcoins

If you're interested in a hardware wallet, I've attached a video here with reviews and recommendations.

In closing, it's definitely worth mentioning that even with a hardware wallet, you definitely have risk, but you can eliminate it and you need to protect your seed phrase - a list of words that are necessary to recover your funds. It's best to write this phrase down on a pepperpot and store it somewhere thoroughly.

If you found this educational post interesting, drop me a comment and give me a follow :)