There are periods of positivity in the market. Everyone is figuring out what grows more and what is the best choice for maximum profits. There are also periods of gloom and negativity. And then there's something in between. In Czech, I would call it "zero from zero is zero." Just times when nothing happens and the market just goes right. And that's exactly what we're in for, according to a well-known billionaire investor.

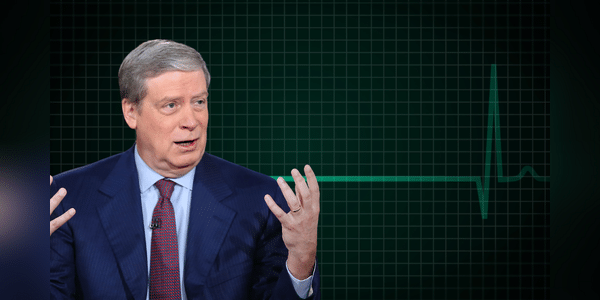

Billionaire investorStanley Druckenmiller sees the stock market outlook as bleak and says it is highly likely that the stock market will be flat for 10 years.

"In my view, there's a high probability that the market will be at best 10 years or so at zero, something like a 66 to 82 year period," Druckenmiller said in a discussion with Alex Karp, CEO of data company Palantir, according to a video uploaded Tuesday on YouTube. The video is quite interesting, by the way. Recommended.

https://www.youtube.com/watch?v=0sddHG0D0Y4

Mos…

Super!

how am I good at trading, stocks, choosing a classy broker

Please help me