This gas company will benefit from an $80 trillion market in the coming years

Gas and overall energy stocks are now a common part of news or analysis. I think we all know the reason. A company with a similar focus will also be the subject of this text. The latter has a lot of potential to make big money from a market that harbors a huge pro opportunity not only for gas companies but other companies as well.

According to Swiss Reinsurance Company Ltd, commonly known as Swiss Re, one of the largest reinsurers in the world, that market with a giant amount of capital is infrastructure. Or rather, building it. What is Swiss Re's basis?

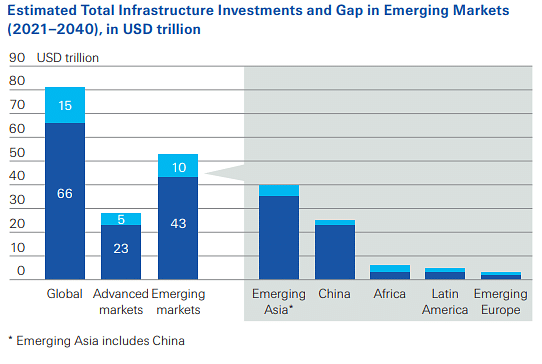

According to them, the greatest potential lies in EMDE (emerging market and developing economy) countries. Infrastructure development in these countries represents an investment opportunity of $920 billion per year. Yet despite this potential, only about $100 billion of private finance has been invested in recent years.

(2021-2040) in $ trillion, source: swissre.com

Moreover, these investments were overwhelmingly in developed countries. It can be assumed that developing countries will not have large amounts of money to invest in infrastructure in the coming years either. This is precisely the opportunity for institutional investors, which Swiss Re estimates have $80 trillion in assets.

One of the many companies that can enter such a market is Brookfield Infrastructure $BIP, which operates and owns utilities, transportation, data services, as well as natural gas transportation, among others.

How can Brookfield Infrastructure specifically take advantage of this?

First, acquiring operating infrastructure businesses from governments. These transactions provide governments with capital to invest in new infrastructure. Second, offering permits to build and operate infrastructure. These transactions allow governments to transfer capital requirements to third-party investors. Third, participating in government-backed infrastructure investments. These investments allow governments to incentivize investors to build infrastructure supported by tax breaks and other benefits.

A closer look at the company

The stock is now trading at $36.6, down more than 10 than it was at the beginning of the year. The actuarial price therefore gives the company a PE ratio of around 43. The market capitalization is $23.86 billion. The last dividend paid was $0.36 per share, so in total Brookfield has a dividend yield of almost 4%. The high payout ratio (more than 150%) combined with the regular issuance of new shares, which has increased by almost 35% since 2014, may be a problem.

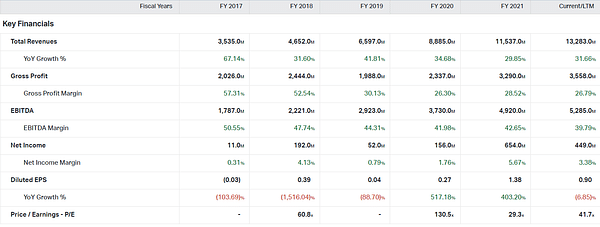

Taking a quick look at the financials, we can notice a regular increase in revenue. In the past year, revenue has already exceeded $11.5 billion, representing a year-over-year growth of nearly 30%. While we can see that growth is slowing down, it is still very strong. Gross profit reached a record $3.29 billion last year. However, gross margin fell to 30% in 2019 and has been at similar levels since then. In terms of EBITDA, which some investors may prefer over net profit, which was also a record last year. Earnings before interest, taxes, depreciation and amortization came in at $4.92 billion. The company maintains a decent EBITDA margin at 42.65%. The company has maintained profitability over the years, earning $654 million last year. It has also managed to increase its net margin, which was last at 5.67%. That's not bad considering the focus of their business.

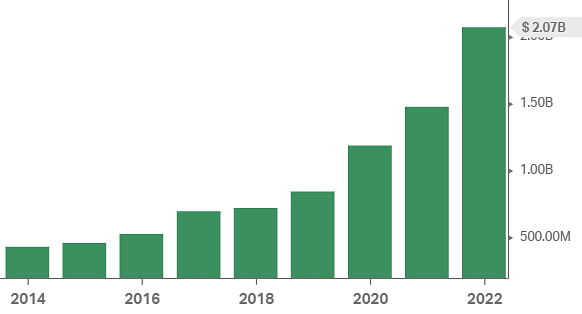

Looking at cash flow, we can see that the company is managing to generate decent cash. Last year they had $705 million of free cash flow left, which is a 33% reduction from 2020. Another important item is CapEx, or cost of capital. These have been increasing year on year, which is understandable given their business (operating pipelines, power lines, railways, highways...). Last year, the company spent $2.067 billion to renew its assets.

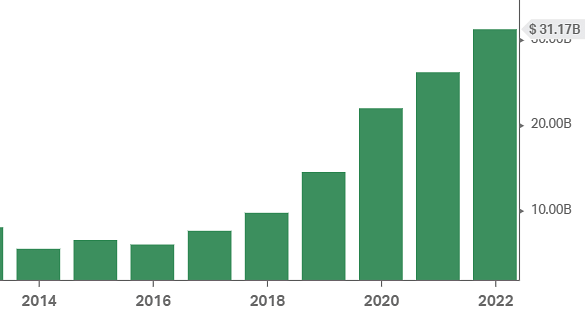

One of the things I would single out within the balance sheet is Goodwill, a kind of intangible capital. Goodwill is regularly increased by billions of dollars year-on-year, which is due to numerous acquisitions. Debt, either total or net, can be a problem for a company. As we can see in the screen below, the debt is growing really big and fast. Last year, it reached $33.354 billion, which is three times bigger than in 2017 (!).

Analysts' view

Wall Street: 10 out of 12 analysts rate the stock either a Buy or Strong Buy. Then one Hold rating and one Strong Sell rating were given

Quantitative rating: a rating of 3.17, i.e. neither buy nor sell

CNN Business: 11 out of 11 analysts rate the stock a Buy, setting their price target within the next 12 months at $47, up 28.4%

Summary

The company looks interesting, having shown decent growth over the past few years. This may well continue in the future, unless the company's huge debt problems catch up with it.

In any case, I find the idea of Swiss Re interesting and the infrastructure sector may present an interesting opportunity for companies to expand their business. Personally, however, they are not planning to buy Brookfield shares yet. However, I will keep an eye on the company.

Disclaimer: This is not an investment recommendation.