Based on the fundamentals, experts are still somewhat skeptical about the market development. Unfortunately, even technical analysis does not have good news for investors. The charts show that a bull market is still not in sight. Find out why here!

But let's start on a positive note - the stock market's long-term prospects have improved in recent months. Or at least according to the experts and their chart analysis. In fact, they rate the market's performance so far this year as average - which is a good thing. Given this year's bear market, "average" performance actually looks pretty good.

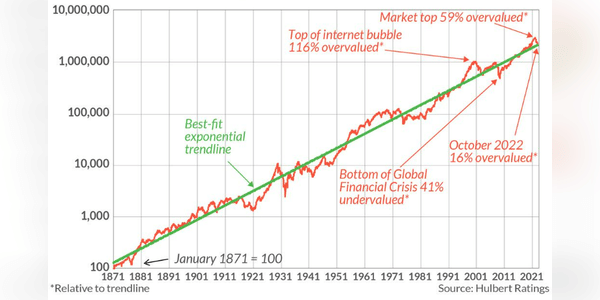

Except what does average mean? It means compared to the trend. And that trend is based on a really, really long history and a lot of data. In fact, at its October low, it stood fairly close to the top of a trend line based on the stock market's inflation-adjusted total return since 1871.

fsghfsd gsdjhg

Hubo un tiempo hace años en que las únicas personas que podían comerciar activamente en el mercado de valores eran las que trabajaban para grandes instituciones financieras, casas de bolsa y casas comerciales. La llegada del comercio en línea, junto con la difusión instantánea de noticias, ha nivelado el campo de juego, o deberíamos decir comercio. Las aplicaciones comerciales fáciles de usar y el 0% de comisiones de servicios como Robinhood, TD Ameritrade y Charles Schwab han hecho que sea más fácil que nunca para los inversores minoristas intentar operar como los profesionales.

great

This Good Information, Thank's!!!

The Meta job cuts are just the latest sign of pain in the tech sector, coming after Elon Musk, Twitter Inc.’s new CEO, fired almost half of the company’s workforce.6