Looking for an interesting REIT with a high and relatively safe dividend? Then Uniti could be right for you

REITs are a popular investment option. But most investors are only familiar with the obligatory O. But there are many other options that might be of interest to investors.

Uniti Group is a real estate investment trust that focuses primarily on the purchase and construction of fiber optic, copper and coaxial broadband networks and data centers.

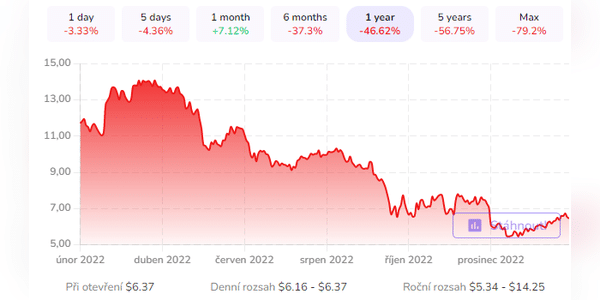

The business was formed through a spin-off from Windstream Holdings in 2015. Over the past three years, the stock has traded in a range of a low of approximately $5 in mid-2020 at FFO of approximately $3 to a high of approximately $14 in early 2022 at FFO of $8.

Prior to 2022, UNIT's performance lagged that of its competitors - American Tower $AMT and Crown Castle $CCI- but then caught up significantly. But the company is generating high margins in a critical recession-proof sector . Their renegotiated master lease agreement with Windstream also provides greater stability and predictability of…