This time we're going to look at Ally Financial, a company that I've had in my portfolio for some time myself. I first opened a $26 position here, and it's one of the companies where Warren Buffett himself has invested. What makes it interesting for investors?

Ally Financial is an American financial services company that focuses on auto finance, mortgages, banking and investments. It is known as a leader in auto financing and provides a wide range of services including auto loans, leasing services, home purchase loans and personal bank accounts. The company also offers investment products such as certificates of deposit and is developing its online banking and digital financial services.

Individual segments of Ally 👇

Banking: Ally Bank offers a wide range of banking services including personal accounts, savings accounts, and CDs.

Investing: Ally Invest offers a wide range of investment products including stocks, options, securities and ETFs.

Financial Advisory Services: through its Ally Invest Advisor Services division, Ally provides financial advice and portfolio management for investment clients.

Leasing: Ally Commercial Finance offers leasing services for small and mid-sized businesses.

Financial Technology: Ally also focuses on the development of financial technology and digital services.

By far the best segment, however, is auto financing, which accounts for the bulk of the company's revenue, and this segment has seen decent growth in recent years 👇

Ally's business is thus highly dependent on automotive lending

While the bank has worked to expand its customer offerings, including Ally Invest, Ally Credit Card and Ally Lending, it still relies heavily on automotive lending as a large part of its business. Last year, Ally generated $4.1 billion in revenue through its auto finance business, 66% of its total revenue. For this reason, the bank is very sensitive to changes in the auto lending industry.

Supply chain issues related to the pandemic, including a shortage of computer chips, have affected automotive manufacturing quite a bit over the past few years. As a result, used cars have been hard to come by and costs have risen sharply.

- This was also one of the reasons why we saw a bigger drop in the stock, which Buffett's Berkshire took advantage of when it bought ALLY stock in 2022.

2022

According to the Manheim Used Vehicle Value Index, the cost of used cars rose nearly 67% in January 2022 compared to January 2020. These increased prices helped Ally at one point get larger loans on the cars it sold. Then in the second quarter, the bank made $13.3 billion in auto loans, the highest quarterly increase since 2006.

But vehicle prices have fallen since then - a good thing for consumers, but not necessarily a great thing for Ally. Used-car prices are down nearly 16% from their peak in January, and the tougher economic backdrop has taken its toll on Ally's business. Loan originations fell 7.5% to $12.3 billion in the second quarter, and investors also worried about deteriorating credit quality.

- This would only serve to justify a larger drop in the share price of $ALLY.

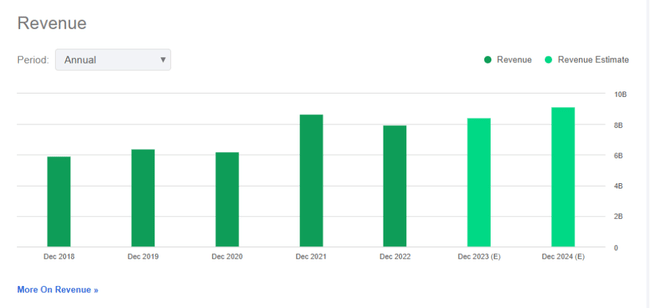

The company did relatively well during the covenant, which translated into a bigger jump in terms of revenue. Since then, the revenue trend has not been that pronounced and I personally expect really modest growth to maybe even stagnation in terms of growth. Analysts are expecting a growth of like 6-7% per year, but my estimate is a little bit lower, I don't think we should expect bigger jumps over the next quarters and maybe years.

- Excluding 2022, average revenue growth over the last three years has been less than 9%.

- If we look at it with a little more distance, over the last 10 years it has averaged 4.6% growth.

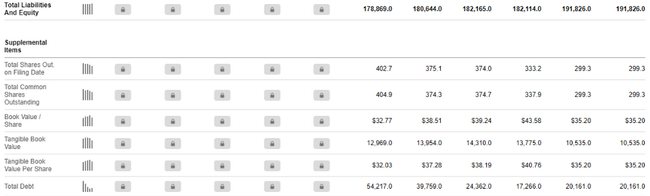

But the important aspect is debt and cash position. In the Cash and Equivalents column, we see a slight decline from 2021 onwards, which is mainly due to efforts to reduce debt, which has been gradually declining in recent years. However, we can see both short-term and long-term debt on the rise in the past year. Specifically, short-term debt saw an increase (from 2021 to 2022) from $62m to some $2.4bn, and long-term debt jumped from $10.7bn to $15.7bn over the same period.

- Total debt is then some $20.1bn with total equity of $12.8bn, giving us a D/E ratio of 1.57, which isn't entirely bad, but it shows that the company is simply borrowing more than it has.

Heading into 2023 and 2024, investors should also expect a slight decline in EPS (according to analysts), mainly due to the release of many of the financial reserves they have set aside for potential loan losses

The company also regularly reduces the number of shares outstanding, which means it regularly conducts share buybacks.

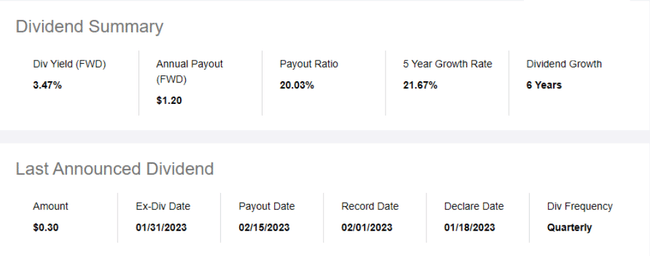

The dividend has been paid since 2017 and has been growing at a fairly rapid pace, which of course won't go on indefinitely, but at this point it's probably sustainable going forward.

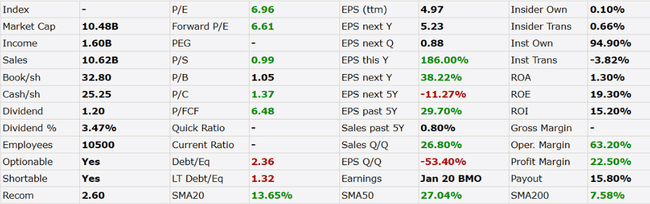

- Looking at the P/E, P/S, P/C and P/FCF ratios, I have nothing to criticize here, for me these are good values.

- The ROA, ROE and ROI have all fallen slightly in recent months, but I still think these are interesting numbers.

The margins are very good in my opinion, we have an Operating Margin of 63.2% and a Profit Margin of 22.5% (but within the last year we have seen a slight decrease here).

The last quarter was quite promising 👇

Net financing revenue rose 1% year-over-year to $1.674 billion in Q4, and jumped 11.1% for the full year to $6.85 billion. Total revenue rose 9% to $2.2 billion in the quarter and for the full year rose 2% year-over-year to approximately $8.4 billion, a record. Net interest margin (NIM) for the full year was 3.85%, up 31 basis points.

The auto finance segment declined 15% in the quarter to $9.2 billion. The yield in the quarter was 9.57%. Net income declined to $251 million from $624 million in the fourth quarter of 2021. The primary reasons were higher loan loss provisions due to credit normalization and expectations of a slowing economy, as well as higher non-interest expenses primarily related to costs associated with the termination of the old pension plan.

Let's look at the price targets

The 19 analysts offering 12-month price forecasts for Ally Financial have a median target of 35.00, with a high estimate of 51.00 and a low estimate of 21.00.

Conclusion

Ally Financial is a financially sound company that is stable and has a solid balance sheet. They have seen revenue growth and improved profitability in recent years. Their assets have also increased while maintaining decent liquidity and solvency. Overall, Ally Financial is in a strong financial position and is performing well given the circumstances and challenging market environment.

- At this time, I personally intend to continue to hold the stock.

Please note that this is not financial advice. Every investment must undergo a thorough analysis.