Cathie Wood is known for not focusing so much on the current situation, and with it the relatively boring stable stocks, but likes to move into riskier markets, and tries to invest in innovative companies. Since the beginning of the year she has started to significantly strengthen her two positions in the portfolio, which she seems to believe in. Let's take a look at what the 2 stocks are.

Since the beginning of the year, there has been a wave of optimism in the markets that has pushed the major stock indices higher. Here again, this sentiment has fueled the desire of some investors to start investing in more speculative stocks again. Cathie Wood is no exception, having come to the attention of investors in 2020 thanks to its investments in risky and innovative companies. In short, she sought out companies that could change the world in the future. Now, since the beginning of this year, Cathie Wood has started betting big on 2 companies, and it looks like she believes in them even in these tough times.

Beam Therapeutics Inc. $BEAM

Beam Therapeutics Inc. is a biotechnology company that specializes in developing precision genetic drugs using its proprietary base editing technology. The company's mission is to create a new class of genetic drugs that enable precise, predictable and effective DNA and RNA transcription, offering new treatment options for a wide range of diseases. Beam Therapeutics' base editing technology enables precise changes to the DNA and RNA of living cells. This technology combines a CRISPR/Cas enzyme with a modified guide RNA and a base-editing enzyme to make specific changes to the genetic code. The company's proprietary platform is designed to enable the creation of new therapies for genetic diseases previously thought to be untreatable.

The company currently has several programs in various stages of development focused on addressing genetic diseases. The Company's most advanced program is BEAM-101, a treatment for sickle cell anemia and beta thalassemia, which is currently in Phase 1/2 clinical trials. Other programs in preclinical development include treatments for liver disease, eye disease and oncology.

Benefits:

- Innovative Technology: Beam Therapeutics has developed an innovative basic editing technology that has the potential to revolutionize the treatment of genetic diseases. This technology enables precise and efficient editing of DNA and RNA, offering new treatment options for a wide range of diseases.

- Powerful Pipeline: The Company's pipeline includes several programs in various stages of development with a focus on addressing genetic diseases. The most advanced program, BEAM-101, is in Phase 1/2 clinical trials and has shown promising results in the treatment of sickle cell anemia and beta thalassemia.

Disadvantages:

- Early-stagedevelopment: although the company has promising results, it is still in the early stages of development and its basic treatment technology has not yet been approved by regulatory authorities. This means there is still a long way to go before any of the company's therapies are available to patients.

- Competition: Beam Therapeutics faces competition from other established biotechnology companies such as Intellia Therapeutics, CRISPR Therapeutics and Editas Medicine, which are also developing gene editing technologies.

- Regulatory Challenges: Like any biotechnology company, Beam Therapeutics will face regulatory challenges in getting its therapies approved by the FDA and other regulatory authorities. There is no guarantee that its therapies will be approved, and the approval process can be time consuming and expensive.

- High research and development costs: the development of new therapies is an expensive and time-consuming process, and there is always a risk that clinical trials will fail, which could cause the Company to incur substantial losses.

As is usually the case with Cathie Wood, this is a highly speculative investment. The company is practically in its infancy, and its technology is in the testing phase. As a result, the company is now unable to generate virtually any revenue from sales. The only revenues the company is generating at the moment are from collaborations and partnerships. Researching the company's technology and testing it has cost the company a significant amount of money, so even these minimal sales are not able to be converted into profit.

As far as the company's balance sheet is concerned, it looks very stable. The company has approximately EUR 965 million in current assets. USD 665 MILLION. This would be enough to fund research and testing for the next 3 years or so. The company also has minimal debt. The value of assets net of liabilities here comes out to me at about USD 13 per share.

Along with Cathie Wood, 6 other analysts who have looked at the company recently also lean on the optimistic side. In particular, they see a lot of potential here as the company will benefit from its partnership with Verve Therapeutics.

In 2023, we expect two key updates from Beam's partner, Verve, to propel the company's stock higher. Beam's partner Verve uses Beam's core editing technology in its lead program (VERVE-101) for in vivo gene editing. In 2023, we expect Verve to provide updates: first, management's response to the FDA's clinical hold on VERVE-101 (potentially in mid-2023); and second, the first clinical data from VERVE-101 that precludes base editing (in the second half of 2023). We believe that these catalysts will have a direct impact on the company, each causing an increase of approximately 10%.

The 6 analysts agreed on an average target price of roughly around $70 per share.

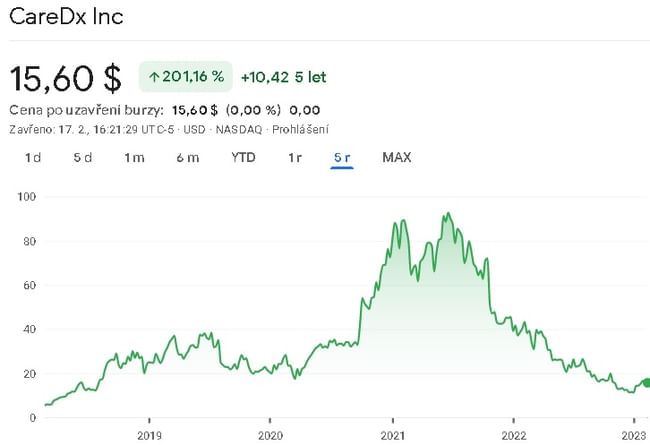

CareDx, Inc $CDNA

CareDx, Inc. is a molecular diagnostics company that develops, markets and delivers diagnostic surveillance solutions to improve the lives of patients with chronic diseases. The company's primary focus is transplant diagnostics, where they provide testing services to monitor the health status of transplant recipients. As part of its product portfolio, CareDx offers a range of diagnostic solutions for heart, lung, kidney and liver transplant patients. These include AlloMap and AlloSure tests, which use gene expression profiling to detect rejection and help physicians monitor the health of transplant recipients.

Benefits:

- CareDx is a well-established player in the molecular diagnostics market with a strong focus on transplant diagnostics and a growing presence in oncology.

- CareDx's innovative technology and strong relationships with healthcare providers have helped the company maintain its position as a market leader in the highly competitive transplant diagnostics market.

- The acquisition of Deciphex allows CareDx to expand into new markets such as oncology, which could provide the company with new revenue streams and growth opportunities.

Disadvantages:

- As a mid-market cap stock, CareDx may be more volatile than larger, more established companies in the healthcare sector, which could make it riskier for some investors.

- The molecular diagnostics market is highly competitive and CareDx faces strong competition from other companies offering similar diagnostic solutions.

- The success of CareDx's product portfolio is highly dependent on regulatory approvals, which can be unpredictable and subject to delays.

- The Company's focus on transplant diagnostics could also limit its growth potential in other areas of the healthcare industry.

The company's revenues have grown at an average annual rate of 100% over the past 5 years. Again, since it is a relatively innovative company trying to revolutionize healthcare, its costs for research, marketing, administration, etc. are too high at this point. So the company is not generating a positive net profit at the moment. But there is a huge growth. Because if I look at the gross profit, it has been growing at an average of about 130% a year for the last 5 years. The average gross margin over the last 5 years has been around 60%. So if the company partially eliminated its costs, it would be profitable.

As regards the balance sheet, the company has a decent financial stability, being able to cover all its liabilities from current assets only. The value of assets net of liabilities here comes out to me at about USD 9 per share. So from a debt perspective, everything looks fine.

Again, Cathie Wood is not the only one who likes the stock. 4 other analysts have looked at this stock recently.

CareDx remains well positioned as a leader in an attractive market, and several catalysts are still on the table for 2023, including AlloSure Lung, AlloMap Kidney and UroMap coverage, a turnaround to EBITDA positivity, and eventual mix and collections stabilization (especially after the 110% revenue collection in 4Q). We believe aligning our 2023 model similar to how we believe the company will be run is appropriate and remain comfortable with our valuation.

These 4 analysts agree on an average target price of $31, implying a share price upside of approximately 100%.

Conclusion

As you can see, these 2 stocks exactly meet Cathie Wood's requirements. These are innovative companies that are capable of revolutionizing their industry. However, in my opinion, in the first case, this is still music of the distant future, which we will have to wait for. In the second case, the company looks interesting. It may not be generating a net profit, but it is generating a relatively fast-growing gross profit, which it is then able to use to fund further research, and any costs needed to grow the company.

For me personally, this is a very risky and speculative stock. There are still a lot of unknowns, and I would also like to see a positive net profit, which in the latter case may soon be the case. Personally, I will only put CareDx on my watchlist, and will continue to monitor it as the situation around it develops.

DISCLAIMER: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.