BlackRock's former chief equity strategist says the S&P 500 index will fall at least another 17%

BlackRock's former chief equity strategist, argues that despite strong labor market data and a less hawkish Fed, warning signs of a recession in the U.S. economy are still piling up. Indicators such as yield curve inversion, declining manufacturing activity, negative money supply growth, tightening credit standards and shrinking corporate profit margins suggest that a recession may be inevitable.

Signs that a recession is creeping into the U.S. economy continue to accumulate, says Bob Doll, CIO of Crossmark Global Investments and former chief U.S. equity strategist at BlackRock.

Strong labor market data and a less hawkish Federal Reserve are distracting investors from the pain to come, he said. Doll isn't saying it's not a good idea to be invested at the moment; rather, he's bothered that some investors are ignoring news supporting the coming recession.

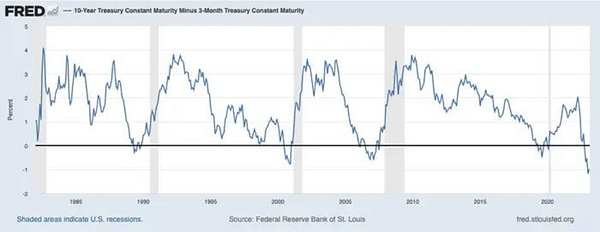

Take the yield curve, for example, which is at its most inverted level in more than four decades. Yields on shorter-term bonds, which are rising higher than long-term bonds, reflect tight monetary policy and low investor confidence in the economy's short-term prospects. The curve has inverted before every recession since 1960.

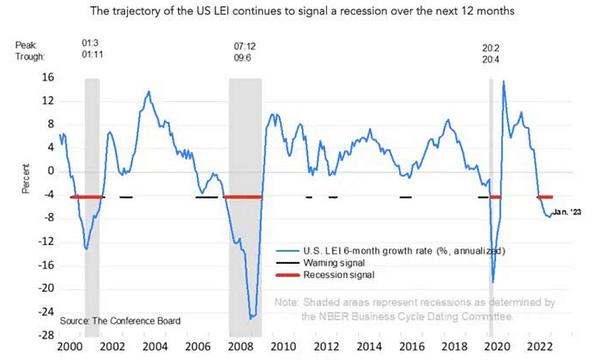

Then there's manufacturing activity, Doll said, which is falling in many major economies around the world, including the U.S., U.K., the eurozone and Brazil.

Including both of those indicators and several others - such as consumer sentiment and stock performance - the Conference Board's economic index is now in recession territory.

Money supply growth is negative for the first time since the Fed began tracking the data in 1950, Doll pointed out. And credit standards are tightening, he said.

"According to a survey of senior loan officers, the percentage of banks becoming less willing to lend to consumers has increased to levels never associated with a recession," Doll said.

- Corporate profit margins also declined 1.5 percent, a level seen in previous recessions, he said.

On top of that, the impact of the Fed's tightening campaign has probably not yet fully manifested itself. And after sticky inflation data and an extremely resilient employment report for January, the Fed's final rate is expected to continue to rise, Doll said.

"What the Fed did last year hasn't affected the economy yet," he said. "What the Fed does usually affects the economy six to 12 to 18 months after it does it."

With Doll expecting a recession, he expects earnings estimates to fall, sinking the S&P 500 to about 3,300 to 3,400 points.

"The S&P's current 18.5 times 2023 expected earnings multiple of $224 looks too rich given the current economic uncertainties and our economic expectations," he said.

- As for timing, Doll said he expects the recession to show up by the end of 2023.

However, he also expects a recession in other

A number of Wall Street strategists and economists now see a recession ahead. The Fed's so-called yield curve-based recession probability tracker also now estimates the probability of a recession at as high as 57%.

Earlier this week, JPMorgan's chief global markets strategist Marko Kolanovic warned that a recession is all but guaranteed if the Fed is truly committed to returning inflation to its 2% target.

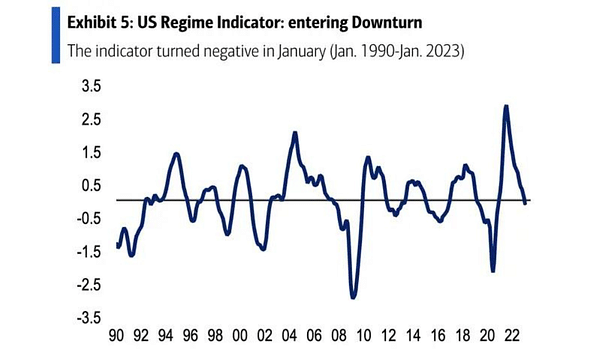

Savita Subramanian, chief U.S. equity strategist at Bank of America, also said this week that an indicator the bank has developed shows the U.S. economy is headed for recession 👇

- How do you see it? Are you counting on a recession and a tens of percent drop?

Please note that this is not financial advice.