Feed

The war in Iran is bringing uncertainty to the U.S. stock markets. 🇮🇷/🇺🇸

But what should we actually be worried about, and how do I think this whole situation will play out?

Shares of companies that manufacture combat drones, such as $ONDS, $AVAV, $UMAC, $RCAT or even $DPRO, are rising by several percent, some even by 10% or more.

It’s important to understand the perception and...

Read more

Did anyone buy shares of Palantir $PLTR in 2026?

I know this stock was often at the center of discussions and in stock news headlines when it was growing at a rocket pace in recent years. But the current decline (the stock is already 34% below its peak) isn’t being talked about much.

...Read more

Zobrazit další komentáře

Paradoxically, I bought only after that big run-up and I’m not complaining at all, because I’m still sitting on a solid profit.

When to sell a portfolio winner? Hold like Buffett, or realize the gains?

Personally, I think that if an investor has a stock in their portfolio that serves as the main source of growth, they should hold it as long as possible—until its valuation becomes unreasonable (for example, like with $PLTR) and as long as growth doesn't slow or the company's fundamentals don't deteriorate...

Read more

Zobrazit další komentáře

Like Buffett, but I trimmed AJG because it wasn't doing well and APH because it was doing well.

Bulios Black

This user has access to exclusive content, tools and features of the Bulios platform thanks to their subscription.

Palantir and the market reaction

$PLTR fell sharply today, despite the company reporting better-than-expected results for the third quarter of 2025. Revenue reached approximately 1.18 billion USD, which beat analysts' consensus of around 1.09 billion USD, and earnings per share were also slightly higher than expected. Nevertheless, the shares lost about 7 to 9 % during the day,...

Read more

Zobrazit další komentáře

The market should have reacted the other way. I've been buying this year and I'm happy😃

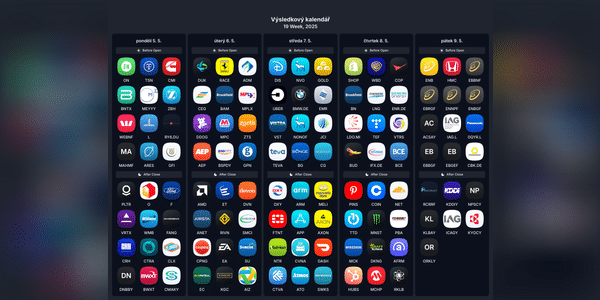

📅 This week's key market events!

Earnings season continues, especially in the technology and pharmaceutical sectors. Added to this are macro data that may stir market expectations for the next rate hike. Here's a round-up of the highlights:

🔵 Monday

Results before the markets open:

OnSemiconductor $ON - need to watch demand for chips in the automotive sector

Tyson Foods $TSN - price...

Read more

Zobrazit další komentáře

Palantir will report the results today. The stock has rallied very nicely last year and this year and is already expensive for most investors. I bought in under $100 this year, even though it was a risk, and have been in decent profit since. If the stock drops below $120, I would buy again.

What is your opinion on the current valuation of $PLTRstock ?

Zobrazit další komentáře

The stock is extremely overpriced and it doesn't make sense to me to buy it now.

Palantir will report the results today. The stock has rallied very nicely last year and this year and is already expensive for most investors. I bought in under $100 this year, even though it was a risk, and have been in decent profit since. If the stock drops below $120, I would buy again.

What is your opinion on the current valuation of $PLTRstock ?

Which company in your portfolio do you think has the biggest competitive advantage?

For me, it's definitely $ASML, because it basically has a monopoly and the world couldn't function without it. I would choose $PLTR as my second firm because it has a strong position and a very good name with the US government.

Zobrazit další komentáře

I would also pick $ASML because there are few companies like that on the market and the current valuation is still great.

Shares of $PLTR rose 7% on Friday after Ecuador announced its partnership with Palantir. The stock is already up more than 75% this year, a solid performance, and the positive trend is likely to continue. I've been buying around $100, and if the stock were to fall again, I would definitely overbuy.

At what price would you overbought$PLTR?

Zobrazit další komentáře

It's still terribly expensive and I think there are better opportunities on the market right now. For me it would be interesting up to around $80.

Zobrazit další komentáře

📅 Investment outlook of the week!

This week we have corporate earnings across various sectors, the US Fed rate decision and new data from the economy.

📈 Monday

ISM Services PMI - Let's keep an eye on the health of the sector that makes up the majority of the US economy.

🔌 Results before the markets open:

ON Semiconductor $ON - A key player in the supply chain for the automotive and...

Read more

Zobrazit další komentáře

As for the results, this week will probably be more interesting for me than the last one. A number of companies whose shares I hold in my portfolio will report results, and I expect bigger moves because they are growth stocks. I will be watching the results of $PLTR, $NVO, $AMD and $TTD.

Which companies' results will you be interested in?

Zobrazit další komentáře

I'll be most interested in the results of $NVO now, as I already have a large position and hope the stock bounces off the bottom.

How do you determine a fair share price? Do you have your own spreadsheet for this, or do you estimate it from a chart?

I used to do a lot of calculations via spreadsheet, but now it doesn't make much sense to me. As far as fair prices go, Bulios helps me with that now. Otherwise, sometimes I don't really care about the fair price and buy on a significant correction, like $TSLA ...

Read more

Bulios Black

This user has access to exclusive content, tools and features of the Bulios platform thanks to their subscription.

The stocks that react the most are probably $LMT, rising about 8%. I won’t really lose or make much on it today, but I’ll definitely keep watching.