Many people expect growth to continue after a good start to the year. But according to one of Wall Street's best-known strategists, such a scenario is out of the question and, moreover, it is necessary to act quickly before the turnaround comes.

Investors are now divided into two camps. Either they are extremely positive and expect further growth, or they fear disaster. In either case, they are running out of time to save yields from the risk of a catastrophic end, warned a Morgan Stanley $MS strategist .

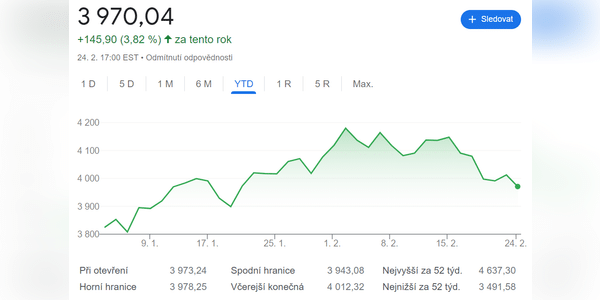

Mike Wilson' s gloomy prediction comes at a time when the S&P 500 index continues to rise, up many percent since its October low, and YTD is currently still 4% in the black even after a slight decline. Morgan Stanley's chief investment officer, who was voted the No. 1 stock strategist in Institutional Investor magazine's October survey , fears the worst.