As you know from the name and the opening photo, today we are talking about a company that specializes in waste collection, transportation and processing. How is one of the bigger competitors to the world-famous Waste Management doing?

What does the company do?

Republic Services $RSG is an American company that specializes in waste collection, transportation, processing and recycling. The company focuses on a wide range of wastes, including municipal waste, industrial waste, hazardous waste, organic waste, and recyclables.

Republic Services provides its services in the U.S. and Canada and currently has more than 14 million customers. The company offers various waste-related services, including waste collection, recycling, hazardous waste disposal, energy recovery and other waste management services.

International Paper's key competitive advantages include:

An extensive ''network'' for waste collection and processing throughout North America, which enables the Company to provide services to a wide range of customers in a variety of areas. This network also allows Republic Services to obtain and utilize waste materials from a variety of sources, which reduces waste management costs and increases efficiency.

Broad Portfolio of Services - Republic Services provides a full range of waste management services, from waste collection and transportation to recycling and energy recovery. This broad portfolio enables the company to offer comprehensive waste management solutions to customers, which increases customer loyalty and competitiveness.

Let's take a look at the company's performance financially 👇

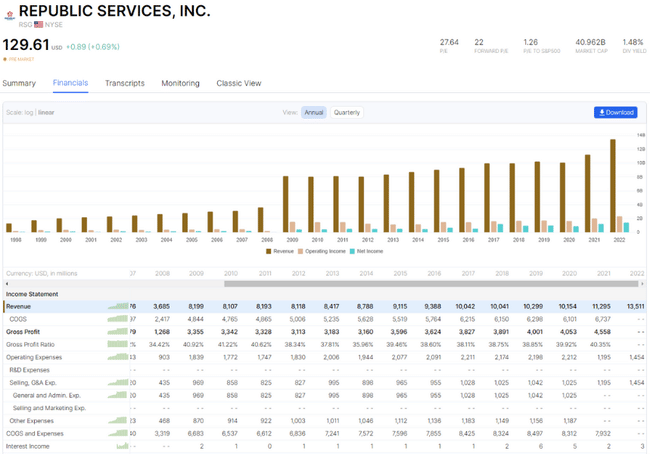

Revenue

- 2012: $8.422 billion 👉 2022: $13.511 billion

- The average revenue growth rate over the last 10 years is 5.2%.

Net profit

- 2012: $0.572 billion 👉 2022: $1.454 billion.

- The average net profit growth rate over the last 10 years is 8.6%

Long-term debt

- 2012: $6.779bn 👉 2021: $9.546bn 👉 2022: $8.4bn.

- The average growth rate of long-term debt over the last 10 years is 3.5%.

Assets

- 2012: $18.999bn 👉 2021: $24.955bn 👉 2022: $28.4bn.

- The average growth rate of total assets over the last 10 years is 2.8%.

Cash flow

- 2012: $1.803bn 👉 2021: $3.016bn

- The average growth rate of operating cash flow over the last 10 years is 5.4%

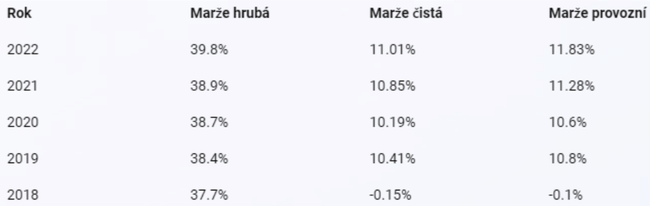

A look at margins 👇

Comparison to competitors - Valuation

For most of you, Waste Management will probably be the most familiar company in this sector, which I will use to compare key metrics as a major competitor.

| x | Republic Services | Waste Management |

| P/E | 27,6 | 28,06 |

| P/B | 4,26 | 9,04 |

| P/S | 3,01 | 3,13 |

| D/E | 1,22 | 2,19 |

| ROE | 15,9% | 31,80% |

Some of the values are lower for Republic Sevices, which is good on the surface, but as far as Waste Management is concerned, it has a larger market share, higher profitability, better returns and lower cost of capital than Republic Services, so in the final analysis Waste Management, the ''king'' of garbage, is better off.

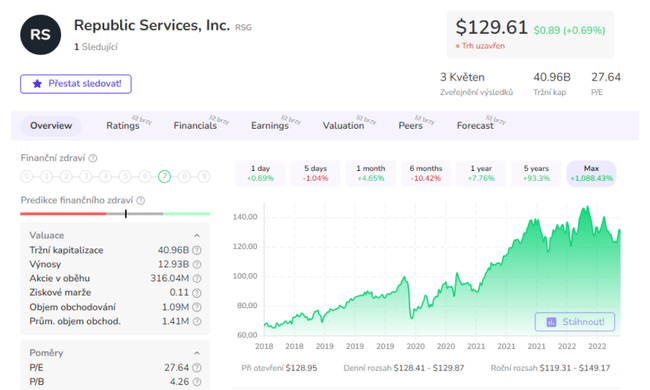

Dividend

Republic Sevices has paid a dividend to its shareholders every three months since 2003, with a current dividend yield of 1.56% for a payout ratio of 38%. The average annual dividend growth rate over the past 5 years has been 7.51%.

Conclusion

Although this business is literally a keeper, the current price is not attractive to me. However, if I were to ultimately choose between Waste and Republic Servicis, I would probably lean towards Waste Management during the downturn for several reasons. Would you be interested in an analysis of Waste Management where I would include the reasons for my preference for Waste? 🤔

Please note that this is not financial advice. Every investment must go through a thorough analysis.