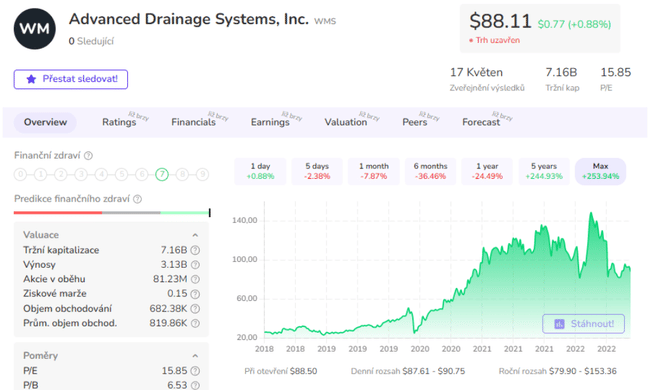

What if I told you that here's a company that has achieved an average annual revenue growth rate of 21.4% and an average annual net income growth rate of 32.6% over the last 5 years, while the stock price has fallen -42% since 2022?

The company in question is Advanced Drainage Systems $WMS, which is engaged in the manufacture and sale of innovative solutions for surface water treatment and drainage, sanitation, and erosion and flood control.

ADS' products include plastic pipes and tubes of various sizes and types, filtration systems, geosynthetic materials and other products for the construction and environmental industries. These products are used for a variety of purposes, such as stormwater management and collection, land drainage, erosion control, sewer construction and more.

What makes the company interesting for investors?

ADS strives to continuously improve its products and technologies to offer customers the most advanced and efficient water management solutions.

An important competitive advantage of ADS is its focus on sustainability and environmental responsibility. The company strives to minimize the environmental impact of its activities and to produce products with the lowest possible energy and emission costs.

ADS's strong distribution network and the quality customer service it offers may also be another competitive advantage. This provides customers with easy access to products and the information they need, enabling them to solve their water problems quickly and efficiently.

Let's take a look at the company's numbers 👇

Sales

- 2022: $2.769 billion

- 2021: $1.983 billion

- 2020: $1.674 billion

- 2019: $1.384 billion

- 2018: $1.286 billion

The average annual revenue growth rate over this period is about 21.4%.

Net profit

- 2022: $0.23 billion

- 2021: $0.185 billion

- 2020: -$0.214 billion

- 2019: $0.099 billion

- 2018: $0.075 billion

The average annual net income growth rate over this period is about 32.6%.

As of 2020 - According to the company's annual report, net income in 2020 was negative due to several factors:

- Increase in selling and administrative expenses.

- Loss on amortization of goodwill and fixed assets

- Increase in interest expense and tax rate

- Decrease in sales due to the impact of the COVID-19 pandemic on demand for their products

Long-term debt

- 2022: $0.818 billion

- 2021: $0.818 billion

- 2020: $0.844 billion

- 2019: $0.854 billion

- 2018: $0.859 billion

Long-term debt is declining at an average rate of 1.2% per year.

Assets

- 2022: $2.65 billion

- 2021: $2.415 billion

- 2020: $2.412 billion

- 2019: $2.354 billion

- 2018: $2.276 billion

The average annual asset growth rate over this period is about 3.9%.

Cash flow

Over the last 5 years, cash flow has grown at a famed 67% per year, but don't count on any big numbers. This is a shift from negative numbers in 2017 to positive $376,590 in 2022.

A look at margins

Gross margins are around 30% at the moment. Net margin has swung from negative numbers over the last 5 years (upward trend the last 4 years) to just under 15% in 2022.

In terms of core metrics, the company is doing much better than most other players in the sector, The only exception is P/B which is higher compared to its competitors.

A higher P/B (Price-to-Book Ratio) may mean that the market expects the company to have future earnings that are higher than the current equity value. Thus, the market may be optimistic about the company's outlook, but at the same time be aware that it will not be able to achieve high returns at the current profit rate.

For some, however, it may also mean that the stock is overpriced relative to its current value and that the market is highly expectant of future growth, which may lead to the risk that future results will not match expectations and the stock price will fall.

Dividend

The Company began paying a dividend in 2019 and has increased the dividend every year since. It paid a total of $0.48 per share in 2022, up 14% from 2021.

What to expect going forward?

By some estimates, Advanced Drainage Systems has a positive outlook for growth as a designer and manufacturer of thermoplastic corrected pipe and related products for water management and drainage. The company plans to expand its portfolio of products and services, increase its geographic presence, and improve its operational efficiency.

How do analysts see it?

The general view is that the stock is undervalued, which is why we also see mostly higher price targets, with estimates for 2023 ranging from $94-$147 per share.

- How do you like the company?

Please note that this is not financial advice. Every investment must go through a thorough analysis.