After several years of underperformance, Greenlight Capital's David Einhorn is back in a big way in 2022. Einhorn's $1.4 billion hedge fund returned nearly 37% last year, crushing competitors and major U.S. indexes that ended the year in the red.

In an interview, Einhorn attributed his outperformance to shorting highly speculative and unprofitable technology stocks that were popular with retail investors during the COVID-induced stock market boom of 2020 and 2021, as well as owning a long portfolio of "boring" value-oriented companies.

Some of the companies Einhorn owns represent deep discount purchases, many of which are more disciplined about returning cash to shareholders, and are therefore obvious choices for him.

Specifically, there are 3 stocks he intends to hold for the long term and recommends holding them even in the challenging environment of 2023. Here are his 3 picks 👇

Tenent Healthcare $THC

Tenet Healthcare Corporation is an American healthcare services company. The company operates hospitals, outpatient centers, urgent care, and other healthcare facilities. Headquartered in Dallas, Texas, Tenet Healthcare has operations in the United States and, in a more intensive form, in Mexico.

Einhorn's investment thesis:

"Tenent Healthcare is a hospital operator. They ran into trouble last year with a labor shortage. They were short of earnings and so forth. We've seen that the multiple is in the single digits, the business seems relatively stable and recession-proof. People go to the hospital and get sick anyway. And you have a company that is now really starting to return capital to shareholders. I think they have a $1 billion buyback against a $6 billion market cap. So when you see an opportunity like that, we've taken a medium-sized position," Einhorn said.

I took a quick look at the risks as well, and there are a few 👇.

Among its weaknesses:

- High debt levels and financing costs

- Dependence on government programs like Medicare and Medicaid

- Regulatory risks and litigation associated with its operation

- Competitive pressure from other healthcare providers

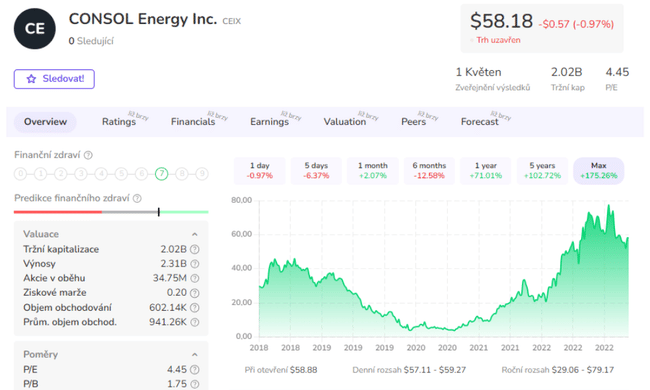

Consol Energy $CEIX

Consol Energy Inc. is a producer and exporter of high-calorific bituminous thermal and transitional metallurgical coal based in Canonsburg, Pennsylvania. Its strengths include:

- Ownership and operation of some of the most productive longwall mining operations in the northern Appalachian Basin

- Ability to deliver coal to domestic and international markets using strategic terminals and transportation infrastructure

- Focus on reducing costs, increasing efficiency and improving safety

- Diversification into natural gas production through subsidiary CNX Resources Corporation

Einhorn's investment thesis is:

"Everybody hates coal, so here's the story. The company has no debt and is worth about $2 billion. I think they'll have about $800 or $900 million of free cash flow this year. Maybe the same amount next year. So pretty much the free cash flow will equal the entire value of the company between this year and next year. They have no debt, so we expect them to buy back [stock] and return that capital. So within a few years, we expect to get almost all of our money back. And they'll still have 30 years of coal reserves in the ground," Einhorn said.

Again, I'm including a look at the risks here 👇

Among its weaknesses:

- Dependence on coal price fluctuations and energy demand

- Regulatory risks and environmental liabilities associated with its operation

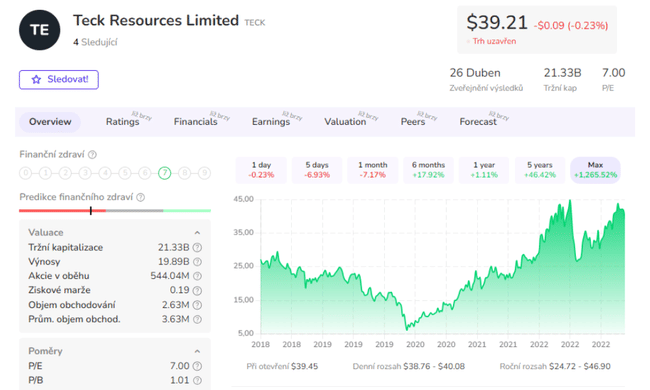

Teck Resources Limited $TECK

Teck Resources Limited is one of the largest diversified mining and metallurgical companies in the world. Its strengths include:

- Recognised leadership in ESG performance with quality assets in attractive jurisdictions.

- A leading producer in several metals and has a diverse product portfolio with demonstrated operational excellence through cost competitiveness.

- Strong financial health with a rigorous capital allocation framework.

- High margins and attractive profit multiples compared to competitors.

Einhorn's investment thesis:

"They will buy their (metallurgical) coal business from their metals business. And they've done it through a spin-off in a really smart way where most of the cash flow over the next few years will still go into the metals business, even though it will come from the coal business, and I think if we have all this electrification, we're going to need a lot more copper. And that's really where the metal part of the business is. It's trading at a not very exciting single-digit earnings multiple, and I think there's very little copper supply in the medium term... If we're going to have all these electric vehicles, we're going to need a lot more copper. So I'm really bullish on copper prices over the medium term and I think Teck Resources will benefit well from that," Einhorn said.

Among its weaknesses:

- Debt and financing costs

- Dependence on metal price fluctuations and commodity demand

- Regulatory risks and environmental liabilities associated with its operations

In conclusion, I think it's clear that we can attribute 2022 performance more to shorts, while this part of the portfolio will be a run for the long haul and for holding for longer periods. For these 3 companies, not everyone may be comfortable with the current prices, but we have to remember that this is more of a game of returning money to shareholders via buybacks or future dividends, or so the interview made it sound.

- How do you like his pick? 🤔

Please note that this is not financial advice. Every investment must go through a thorough analysis.