Charlie Munger spoke at the Singleton Prize for CEO Excellence event last year, where many interesting ideas were expressed. Here he stressed the importance of focus, patience and independent thinking for anyone hoping to beat the market. Let's take a look at his top 5 quotes from the event.

Charlie Munger is an American investor, entrepreneur and philanthropist who was born on January 1, 1924 in Omaha, Nebraska, USA. He is best known as the vice president of Berkshire Hathaway, which he co-founded with Warren Buffett. Munger is known for his philosophical approach to investing, which emphasizes long-term thinking, value investing and the pursuit of continuous learning. Munger is also often quoted for his wise and witty remarks on life, business and investing. So let's take a look at what he said in one of his recent interviews.

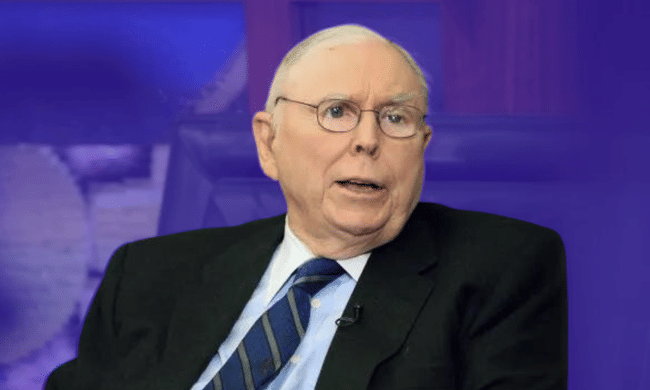

Charlie Munger in an interview with Todd Combs 👇

Munger on his investing approach and the importance of long-term investing:

"It's absolutely possible to do great if you have the right temperament. Just take the long view. What I am is a person who has been able to take a slight obsession and a long attention span and turn them into pretty good results."

Munger on so-called gemblers (speculators) in the stock markets:

"The people who tend to get the best results are not these fanatics who are always looking for new businesses. The best investors don't expect to find 10, 20 or 30 businesses - they just need one or two." (Munger said he knows an investment banker who bet on just two stocks, Home Depot $HD and Eli Lilly $LLY, and became a billionaire as a result.)

Munger on the risks of blindly following the crowd frenzy:

"There's tremendous potential if everyone can get the investment composition right on their own, but it's very hard. The competition is very, very intense. You have to stay out of the seductive frenzy that's going on around you all the time when there are huge motivational pressures. We all like to do what other people are doing. None of us want to move to the North Pole and sit there and make $100 million. We all like to be in nice places like Beverly Hills and have an expensive breakfast there."

Munger also talked about the fact that many confuse the concept of investing with gambling, which is wrong and will not lead to long-term and promising results:

"We have a liquid stock market that's two things at once - it's a place for people who are making long-term investments rationally to go and make their transactions, and it's a place for another group of people who are gambling in the casino. We're mixing the two, totally, which is bad for all parties."

Munger again on speculation, which he likens to gambling:

"Everybody loves gambling, and the trouble is it's like taking heroin. A certain percentage of people, when they start, just overdo it. It's so addictive. It's absolutely crazy and they go crazy. Civilization would be so much better without them." (Munger was referring to the exaggerated hype and reckless speculation in the stock market.)

(3) Charlie Munger in Conversation with Todd Combs | Singleton Prize for CEO Excellence - YouTube

Please note that this is not financial advice.