One of the world's richest people says something else was behind the fall of Silicon Valley banks

The collapse of Silicon Valley Bank (SVB), Signature Bank and Silvergate Bank represents a watershed moment in the world of finance. Let's take a look at the important points and notes that have emerged from this crisis and how social media and technology are completely changing the game in financial risk management.

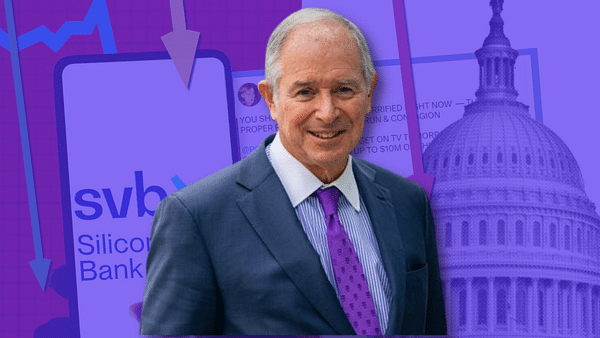

Experts fear that the collapse of these three banks could lead to contagion spreading to the financial sector. However, Blackstone's CEO, Steve Schwarzman, believes that this is unlikely due to the specific technology frenzy surrounding the $SIVB. Schwarzman argues that the current crisis is unlike a conventional crisis and that the risk is limited to the banking system.

This crisis was caused by people on iPhones and other devices hearing on social media that a bank might be in trouble. We only have a temporary problem with rising interest rates and we have a problem with deposits caused by technology. And both are solvable problems for a large number of banks.

The pivotal moment of the SVB crisis was the massive withdrawal of money from the bank after reports of trouble on social media. This mass outflow of cash from the bank caused significant problems and eventually led to the collapse. The collapse of SVB shook the shares of several regional banks and heightened fears of a widespread banking crisis. Although some experts argue that the risk is limited, markets are reacting negatively and expressing fears of further possible collapses.

Social media and smart devices as factors accelerating the crisis

Social media and smart devices are seen as key factors that have precipitated the SVB crisis. The speed with which information is spread through these channels allows panic to spread much faster than would have been possible in the past. Citigroup's chief executive, Jane Fraser, also states that technology has completely changed the game in spreading panic and rumours.

There were a few tweets and then this thing collapsed much faster than it has happened in history. And frankly, I think the regulators did a good job of responding very quickly because normally you have a longer time to react to this.

In the context of the SVB crisis and its impact on the financial market, market observers are pointing out that social media is changing the way we need to think about liquidity risk management. Traditional risk management methods are no longer fast and flexible enough to respond effectively to rapidly spreading information and panic.

New approaches to financial risk management

The growing influence of social media and technology on financial markets makes it essential to adopt new approaches to financial risk management. Institutions need to be prepared to quickly identify potential threats, analyse their impact and take action to mitigate them.

One way to counter the rapid spread of information and panic is to increase transparency and communication by financial institutions. Banks and other financial organisations should be active on social media and communicate regularly with their clients to prevent the spread of misinformation.

Another important step is to educate the public about financial risks and how to read and interpret financial market news. This will help reduce the likelihood of panic caused by misunderstood or misrepresented information.

Conclusion

The collapse of Silicon Valley Bank, Signature Bank, and Silvergate Bank represents an important lesson for the entire financial sector. Social media and technology are completely changing the game in financial risk management and forcing financial institutions to adapt to new realities. It is imperative that banks and other financial organizations rethink their current risk management practices, improve transparency and communication, and educate the public about financial risk.

This case also highlights the fact that financial institutions must be prepared to respond quickly to potential threats and market changes that may be caused or accelerated by social media and technology. It is imperative that financial institutions invest in advanced analytical tools and innovations that enable them to identify and address potential issues more quickly.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.