ANALYSIS OF COCA-COLA SHARES

1Q results

The company's 1Q 2023revenue grew 5% year-over-year to nearly $11 billion, with organic revenue growing 12%. Global unit volume grew 3% y/y and concentrate sales were down two percentage points, mainly due to the timing of concentrate shipments and fewer days in the quarter. Analysts had expected a 0.62% year-on-year decline in concentrate sales.

Comparable operating margin increased to 31.8% from 31.4% in 1Q last year. Free cash flow decreased by approximately EUR 520 million in 1Q. This represents a negative USD 120 million in cash flow. USD

Outlook for 2023

Coca-Cola confirmed all points of its annual outlook. Adjusted organic sales are expected to grow by 7-8% on the company's estimates against market expectations of 7.84%. On a comparable earnings per share basis, the company expects growth of between 4-5%, which includes the negative impact of foreign exchange expected to be 3-4%.

Capital expenditures are expected to reach USD 1.9 billion, according to the information provided

2Q outlook

The company expects comparable sales to be negatively impacted by currency movements of 3-4%. Comparable earnings per share are then expected to be negatively impacted by 2-3%.

| Capitalization (USD billion) | 277,1 | P/E | 25,4 |

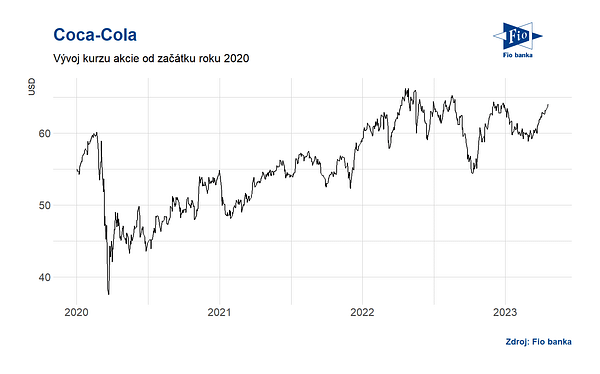

| Development this year (%) | +0,7 | Expected P/E | 24,7 |

| 52-week low (USD) | 54,0 | Average Target Price (USD) | 68,2 |

| 52-week high (USD) | 67,2 | Dividend yield (%) | 2,8 |