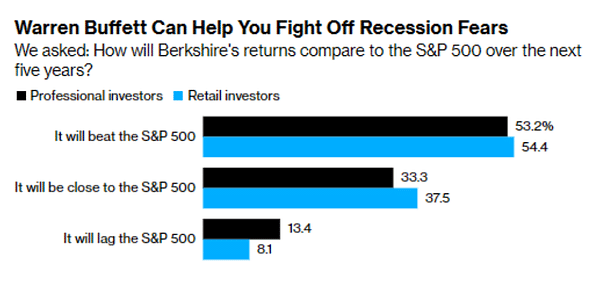

Forget the S&P 500, investor survey shows Berkshire Hathaway stock will be a better choice for the next 5 years

A new Bloomberg MLIV Pulse survey of 352 respondents found that 53.2% of professional investors and 54.4% of retail investors think Berkshire Hathaway will be a better choice for the next 5 years than investing in the S&P 500.

Before you continue reading, go to the comments and feel free to write in and tell me what you think will outperform the S&P 500 index over the next 5 years.

Let's go check out this survey 👇

A large portion of investors believe that shares of Berkshire Hathaway $BRK-B, Warren Buffett's conglomerate, will outperform the Standard & Poor's 500 index over the next five years. A Bloomberg survey of investors found that over 50% of professional and retail investors believe Berkshire stock will outperform the broad stock index.

Conversely, 13% and 8% of respondents, respectively, believe Berkshire stock will underperform over the next five years. The rest of the respondents expect them to perform similarly to the S&P 500 index.

When respondents were asked what they liked best among the stocks offered by Buffett's companies, about 30% chose Coke $KO.

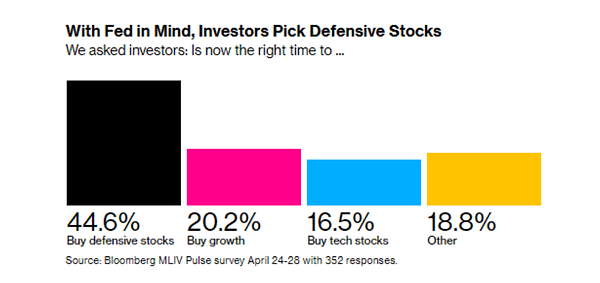

Given the expected recession, 44.6% of investors find defensive stocks most attractive. Growth stocks, technology companies and other options follow in order.

A look at one of the survey's main questions, including consideration for the next 5 years 👇

Ahead of Berkshire Hathaway's AGM this week, 80% of respondents said Buffett's biggest message to investors is this: buy stocks for less than their intrinsic value. And it is in this regard that many think Buffett's Berkshire meets that metric.

Moreover, the survey comes at a time when Buffett has been relatively silent on Berkshire investments in recent years. Although it raised stakes in five top Japanese firms last month, Berkshire holds a huge amount of cash, $130 billion, because it has avoided mega-deals.

But Buffett himself warns investors not to invest as he does. He advises them to put their money in an index fund. He gave the same advice to Tim Ferris in 2008 when a podcaster asked him how to invest a million dollars.

"You're not going to get that advice from anybody because nobody gets paid to give you that advice," Buffett said at the time. "You're going to have all kinds of people telling you how much more and better they can do for you, and as you give them money or give them commissions or whatever, they're not going to do it any better anyway."

- Which is the better choice for you: the S&P 500 x Berkshire?

Please note that this is not financial advice. Every investment must go through a thorough analysis.