Bill Combs

Zobrazit další komentáře

I got a good price on Google, so I'm not buying yet. It's my biggest position, after all.

Zobrazit další komentáře

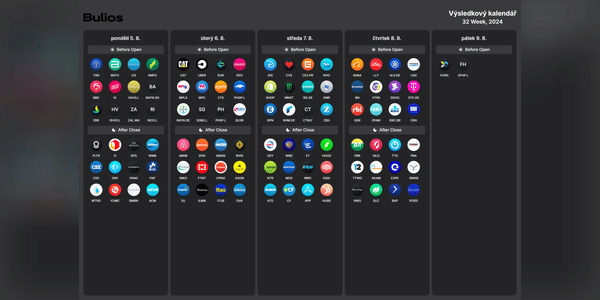

I think the results this week will be the last thing the markets will care about...:)

Zobrazit další komentáře

You caught it nicely. But the overall sentiment in the market is going to bring that appreciation down a lot today. The markets are down real solid today.

I don't have any energy stocks in my portfolio at the moment (except $CEZ.PR) and $CVX makes the most sense for me for now , as I want to hold it mainly for diversification and I'm not looking for mega big growth. The stock has been dropping quite a bit lately, so it's getting to a nice price.

What energy sector stocks are you currently buying?

Zobrazit další komentáře

Good dividend at finally a little lower price😁I'll buy more if the price drops further.

Zobrazit další komentáře

It's a classic and luxury will always be bought, but... CHINA... we have become too dependent on it and the comrades are haunted... Enough with the western decadence... You will drink the Rice brandy... Cognac is anti-human.

Zobrazit další komentáře

Google is my biggest position. I shopped for really very decent values, so the answer ba question is: deep😅

Zobrazit další komentáře

Finally a discount on an expensive stock. Still, the price is still high...:)

Zobrazit další komentáře

The current trend is truly exemplary. Congratulations to all who have bought. I'm not. But Spotify has been struggling a lot with Apple Music lately. Here in Europe it's pretty much winning, but it's the US that's weaker. They had to raise the price if I'm not mistaken. That's how they got above Apple. Still, the numbers are very good.

Zobrazit další komentáře

It's an interesting company among airlines. Low-cost airlines are pretty hot. I don't own any of their stock. I'll take a closer look and if I come to a sensible decision, I'll be sure to let you know.

Zobrazit další komentáře

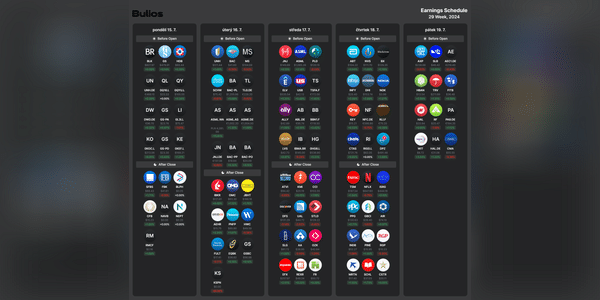

ASML reported its results today, which I thought were solid. $ASML is currently the largest position in my portfolio as it is a great and very high quality company that has a monopoly in this industry. I'm not currently overbought, but if there is a downturn, I'll gladly overbought again.

What do you think of$ASML?

How do you currently feel about $CVSstock ? Are you buying, selling or holding?

In my portfolio ,$CVSis currently the most losing position. Fundamentals are not as nice as they used to be and recent results have not been great either. I am currently holding, but I am no longer overbought and will be very interested in the upcoming results.

Zobrazit další komentáře

Netflixy is going to be a pushover. That's where I think it will be most interesting. Subscribers are what often diminish in the summer as people travel and don't watch movies.

The slump is very good for shopping. I have already established a base position and will be overbought.