Feed

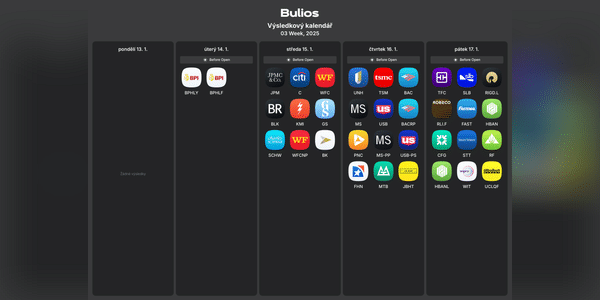

📅 This week's key events!

The results season begins! Apart from inflation data, US banks, tech firms and consumer companies are the main ones coming to the fore.

📌 Monday

Market reaction to Trump's tariffs announcement.

Results before markets open:

Orkla $ORKLY - Scandinavian giant in food, household chemicals and consumer goods.

📈 Tuesday

US CPI Inflation - The monthly consumer...

Read more

Zobrazit další komentáře

There's a lot in there, but for me it's definitely $NFLX and it will be interesting to see the stock reaction to the tariffs today.

📢 US banks increase dividends and buybacks!

The financial sector in the United States has just sent a clear signal to investors: the capital position of the largest banks is robust and so they are rewarding their shareholders. After successfully passing the Fed's stress tests , the banking giants have announced significant dividend increases and the launch of new share buyback...

Read more

Zobrazit další komentáře

It's great news, but I think the buybacks are much better than the dividends.

Zobrazit další komentáře

Honestly, I don't worry about it too much and I still have a long investment horizon, so I don't need to diversify.

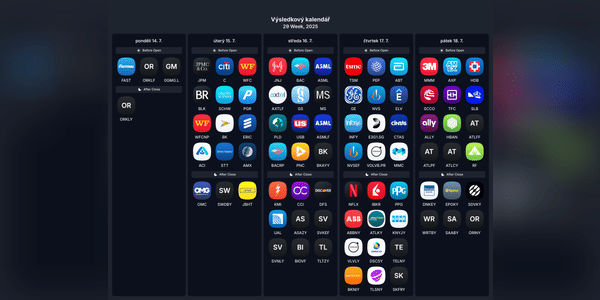

📆 Weekly Investment Review: earnings season in full swing, complete with important data and geopolitics!

A mix of corporate results, economic statistics and geopolitical challenges await us this shortened week. Markets will react not only to the numbers, but also to speeches by central bankers and politicians.

🏦 Monday

Results before the markets open:

Goldman Sachs $GS - I'll be...

Read more

Zobrazit další komentáře

There's quite a bit of this in there. I'll be interested to see where the shares go and there are also results of companies I'm interested in.

Zobrazit další komentáře

Netflix could be quite interesting, and if the results were worse and the stock fell, I might buy.

📊 JPMorgan Chase shone with results. But CEO Dimon warns: Don't expect calm waters!

JPMorgan Chase $JPM, the largest U.S. bank by assets, posted quarterly results that far exceeded analysts' expectations. Earnings per share came in at $5.07, compared to the consensus estimate of $4.61. Net income rose year-over-year by 9 % to $14.64 billion, sales up 8 % to USD 46.01 billion, ma...

Read more

Zobrazit další komentáře

I have $BAC in my portfolio, so I'm waiting for the results, but I'm probably expecting a cautious outlook comment too, probably not very positive.

📉 Financial sector under pressure!

While the beginning of the year suggested that US banks might finally experience a calmer period, recent developments on the geopolitical front have brought a sharp reversal. Donald Trump's administration's sweeping tariff offensive immediately shook the market. The result was the biggest sell-off in bank stocks in months.

Since last week:

Citig...

Read more

Zobrazit další komentáře

That's a pretty solid drop. I'm not buying bank stocks yet, but I'm buying $SOFI too.

We all know it was mostly tech stocks that fell yesterday, but I was very surprised by the drop in $BAC and $JPM. Bank of America stock was down more than 11% yesterday. I have $BAC in my portfolio and I'm happy, but I may overbuy now after the drop.

Will anyone be overbuying bank stocks after the drop too?

Zobrazit další komentáře

In the end, the results of the big banks turned out very well - almost all items exceeded expectations. I have $BACstock in my portfolio and was recently intrigued by @m wise_investor' s article on the City, so I bought $C at the beginning of the year and am very happy so far.

Which bank stocks do you have in your portfolio?

Zobrazit další komentáře

I have a few years of $JPM stock in my portfolio and that's good enough for now. Overall financial sector stocks are very expensive right now.

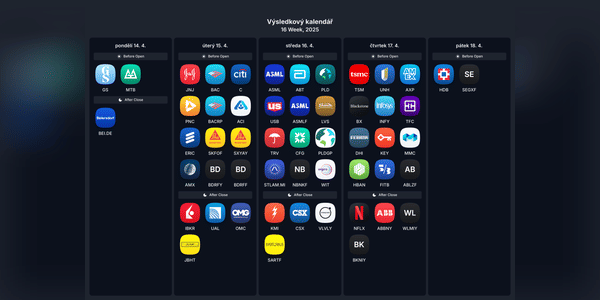

🗓️Týdenní investment overview: key events that move the market!

Earnings season is upon us, with the biggest banking houses in the US kicking off first. Stay tuned for what's ahead! 👀📊

Tuesday:

US PPI inflation: Producer price inflation will reveal whether inflationary pressures in the supply chain are easing. 📦

Wednesday: Big Bank Day! 🏦

U.S. Consumer Price Inflation (CPI): A key...

Read more

Zobrazit další komentáře

Today's inflation will be very important, as it can change a lot of things again and it can influence the Fed's next decision.

Zobrazit další komentáře

Much more important will be how inflation in the US turns out today. Otherwise, I want to look at the $TSM results tomorrow

I will be interested in the results of $NFLX, $BAC and $TSM.