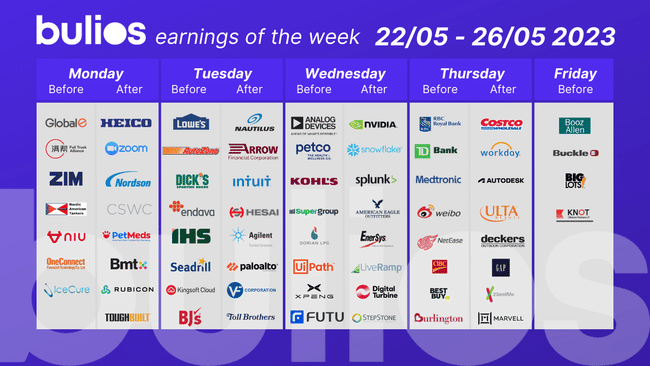

Next week we will definitely not be bored, we have the results season on the agenda, where ZIM $ZIM, Zoom Video $ZM, Palo Alto $PANW, Nvidia $NVDA, Kohl's $KSS, Snowflake $SNOW and Costco $COST will present their latest numbers.

What do analysts expect from these companies?

Zoom Video $ZM

Zoom is expected to report revenue for the first quarter of fiscal 2024 in the range of $1.08 billion to $1.085 billion, representing roughly 1% year-over-year growth, or 3% at constant currency. The Zacks Consensus Estimate is currently $1.08 billion, suggesting a growth of 0.91% from the previous quarter.

Palo Alto $PANW

Palo Alto Networks is expected to report earnings of $0.92 per share, which would represent a year-over-year growth of 53.33%. Meanwhile, the Zacks Consensus Estimate forecasts revenue of $1.71 billion, up 23.65% from the previous year.

Looking at the full year, Zacks Consensus Estimates suggest that analysts are expecting earnings of $4.01 per share and revenue of $6.89 billion. These totals would imply changes of +59.13% and +25.16% from last year.

Nvidia $NVDA

Nvidia is expected to post quarterly earnings of $0.92 per share in its upcoming report, representing a year-over-year change of -32.4%. Revenue is expected to be $6.51 billion, down 21.5% from the previous quarter.

Kohl's $KSS

Kohl's is expected to report a quarterly loss of $0.44 per share in its upcoming report, representing a year-over-year change of -500%. Revenue is expected to be $3.52 billion, down 5.3% from the previous quarter.

Snowflake $SNOW

The Zacks Consensus Estimate forecasts net sales of $607.47 million, up 43.82% from a year ago period. Looking at the full year, they expect earnings of $0.58 per share and revenue of $2.87 billion. These totals would represent changes of +132% and +39.08% from last year.

Costco $COST

Analysts expect Costco to post earnings of $3.32 per share. This would imply a year-over-year growth of 4.73%. Meanwhile, the latest consensus estimate calls for sales of $54.66 billion, up 3.92% from the previous quarter.

- Whose results do you care about? Let me know in the comments!

I am certainly interested in the results of $NVDA and $MDT.

I'm curious about $NVDA and $COST

So here's where I'm really "high" on $NVDA. I'm really interested to see if this stock will calm down or shoot up 16% to a new high.

Nice, already a review, I'm curious about the $NVDA one if it won't be a proper sobering down when even lower profits are expected. Otherwise, dumb question, but where can one get a chart like this? :D I know earnings whispers, but that's not exactly it. :)