Why do the research when someone else can do it better for you?

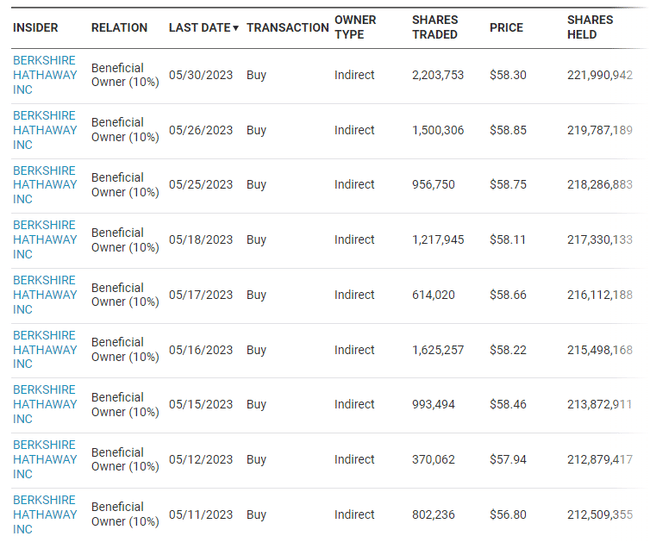

Berkshire Hathaway has been buying large quantities of $OXY for almost a year at a price of around $60. Despite these purchases, the stock price hasn't moved anywhere and is at similar levels.

Such purchases indicate to me that Berkshire has confidence in Occidental Petroleum, so why shouldn't I?

Warren Buffett himself described these purchases as a long-term bet on rising oil prices.

Berkshire Hathaway owns about 25% of $OXY at this point.

I have almost no knowledge of the industry myself, but it seems to me that I wouldn't step in a puddle here.

How do you feel about $OXY?

Well, I'll admit I was the poster child in the Buffett lover's world, watching the portfolio and including it in mine. But I'm not buying anymore, I agree that companies are not doing much, it's still going sideways and there are a lot of commodity companies on the market. I'm not saying it's bad, but really not much so far.

I think I've written here a couple of times how I bought OXY with a similar approach and then went through a divi stop and a drop of about -80% while BRK.B was still getting about 10%pa for its loan in the form of preference shares + options. I understand it's a different situation at the moment, but in general I wouldn't recommend copying anyone because you can't see inside their head and often don't know the whole story.

I have $BRK-B, but I don't gamble with oil. I've had bad experiences with it. On the other hand, it makes sense to me here, but I don't buy their stock even though I think it would be a good investment. It's enough for me to own it indirectly.