Rickie Reeve

I would like to share with you an interesting picture showing the financial cost of maintenance for each car brand. Asian and American brands seem to be the more economical choice compared to European ones.

Does anyone have $LULUloaded ? I'd love to hear your thoughts.

I am unable to evaluate the long-term sustainability of their competitive advantage, which is supposedly all about customer loyalty due to the company's strategy of building a positive relationship with their customers through various workshops, sports lessons, etc. Their site has a very fast turnover of offers,...

Read more

Yesterday, we were finally notified of the day the streaming service Max (from $WBD)will be entering Europe. That day will be May 21, and we can look forward to, for example, streaming the Olympic Games in Paris. Game of Thrones fans might enjoy the second season of House of the Dragon.

Europe is an important region in the streaming business. So I'm curious to see the numbers.

D...

Read more

Zobrazit další komentáře

I don't pay for any subscription yet, although I'm very tempted to, but I somehow can't find the time to do so and then I can't watch the series just one episode at a time, how many times I get hooked and don't even sleep and then put off the essential stuff. 🙈😂 Anyway, I'm glad for this move as I have some of those $WBD shares so I hope this will help them grow 😊.

Yesterday, $BTI provided more details of its plan to sell part of its stake in ITC Ltd and use the proceeds to buy back its own shares.

They intend to sell the shares, representing up to a 3.5% stake in ITC. They will therefore continue to hold a 25.5% stake.

From this sale, the company is expected to raise over $2 billion, which they will use to buy back their own shares over...

Read more

Zobrazit další komentáře

The results of the "tobacco companies" were pretty scattered this week and so were their stock movements :) Some up, some down. $BTI was up nearly 7% yesterday, but the premarket isn't favoring the company and the stock is down 1.7%. We'll see how this plays out. It's a tough business at the moment. Cigarette sales are down.

Zobrazit další komentáře

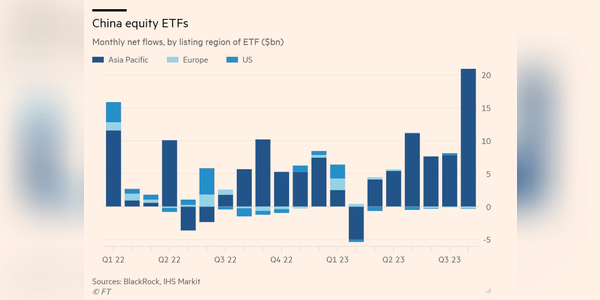

I will add for the world, the US-China relationship is very important. The current situation is well described here https://www.weforum.org/agenda/2024/01/demystifying-the-idea-of-trade-decoupling/

Personally, I wonder if there are any prominent Chinese attending Davos if not being there would be enough of a warning sign for me.

Macro data from China. Month-on-month CPI rose for the first time in 3 months, but slower than expected. This was mainly due to increased spending on travel and shopping during the holiday season. However, overall discretionary spending remains weak due to higher unemployment and concerns about the economy. Despite monetary stimulus from the People's Bank of China, there is no...

Read more

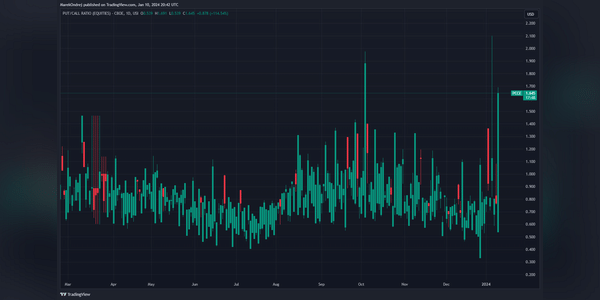

Does anyone use a put-call ratio when timing their inputs/outputs? I'm trying to find out how reliable an indicator it is. In principle, it should correlate with the market in some way.

- Investors buy more puts than calls => bearish sentiment

- Investors buy more calls than puts => bullish sentiment

I'm looking at Upwork $UPWK. It is a platform for freelancers.

I'm trying to evaluate Upwork's moat. I see the main advantage as half the fees compared to competitor Fiverr, 10% X 20% on sales.

That fixed 10% is a new format beginning in 2024, which should boost Upwork's profits considerably. I fear, however, that Fiverr will respond to this move by lowering fees and moat will...

Read more

Local sentiment survey - what % of your portfolio is now in cash? 💸

Personally, I've been selling a lot over the last month and it's now ~32%...

I have it in a savings account at both my bank and Revolut with a decent return.

Zobrazit další komentáře

I'll join in as well, and I'll probably even completely uncover the cards because I don't have it in percentages. Anyway, anyway in 2024 I'd like to try to market the story somehow as they say. I've been through business failure and bankruptcy. About a year and a half ago I was starting from scratch with a clean slate. Well how do I stand for that year and a half. I have $11k in stocks, there currently yielding around 17% for this year. Then I have 32k in gold and about 15k in crypto. Yes, unfortunately the least there, although I believe it will go up in 2024, but I haven't caught the bottom and don't want to buy at those prices anymore. Oh and I always keep 2-3 payouts in the bank as a reserve, but it's not appreciated because it's so I can use it immediately. And then on Revolut I have another $1k ready to go. I always change funds there because of the exchange rate and send funds to the exchange in $1k increments. 😊 ...so I don't hold much in cash right now. Just cash for any emergency needs.

Volkswagen, Audi, Porsche and Scout Motors today announced plans to implement the NACS charging standard for future vehicles in North America starting in 2025 - unlike most other companies that will have access to superchargers as early as 2024.

The transition will be gradual and not all vehicles will be equipped with NACS ports starting in 2025, only brand new models.

$VWAP.BR

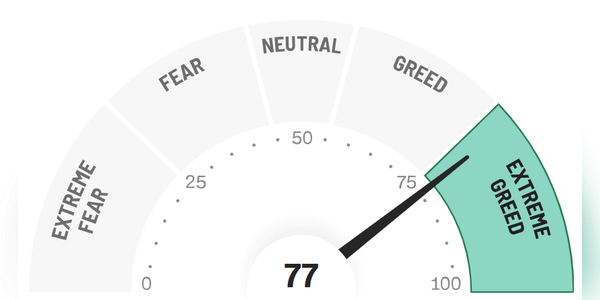

Less than two months ago, we had extreme fear... Like a roller coaster! 📈

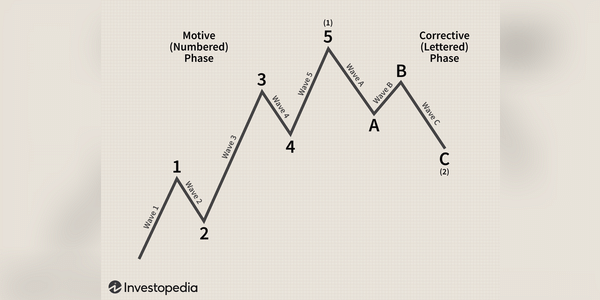

I would like to ask if anyone here is applying eliott wave theory in either short or long term projections.

Alternatively, what is your experience with it - is it worth using this tool?

Zobrazit další komentáře

I mean, so I'll admit, again, something new to me in the investment world, I hope it gets the conversation going, because I don't know it. 😊 But from the chart I understand it's about price averaging most likely.

Zobrazit další komentáře

I know of its existence and have looked into it, but I haven't decided whether or not it's for me :)

For me, it's a car without a soul.