Which of these car companies will provide the best return for investors over the next 12 months? (appreciation + dividend) - let's discuss!

Rickie Reeve

Zobrazit další komentáře

Great, this is very good news which adds some peace of mind in my holding of this company. 😊

Interesting observation, after yesterday's Altria $MO results:

Philip Morris sells more cigarettes in Indonesia than in the US (Altria).

It's one piece to the puzzle that shows how important emerging markets are in the cigarette business. In Indonesia, for example, almost 30% of the population over 15 years of age smoke.

https://x.com/tobaccoinsider/status/1717815293060472995?s...

Read more

Zobrazit další komentáře

But that's not news to me, a lot of tobacco focuses on Asia and young adults(or rather kids). If you start early,it's supposedly harder to quit. This was the reason I said no to tobacco :)

Zobrazit další komentáře

Under 100eur I also have a bell, I will not buy it yet because as Jan writes, it could still fall, but it is definitely interesting, will you buy more Mark? 😊

Zobrazit další komentáře

Also, thanks for sharing and since I'm a bit off the higher prices in the company, I'm now under $100 overbuying, but only slightly. Personally, I'm still expecting a drop. I kind of suspected that they would have deteriorating results this year after Q2. But as you can see from your picture, they should improve again from mid 2024. Of course, no one knows what will happen at that time, but for this company I am not worried about bankruptcy yet, however, now the hold needs to hold and it may be longer.

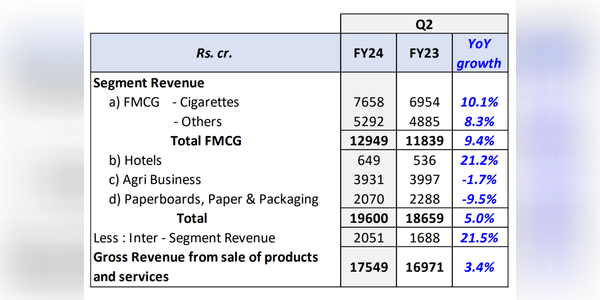

ITC Ltd reported results today. We are talking about an Indian company in which $BATS.L/$BTI has about 30% stake.

Q2 2024

The interesting numbers are from the fast moving consumer goods segment, which includes cigarettes. Cigarette sales are up 10.1% year-over-year. A different trend from the European one.

Read more

I'd like to ask what the views are here on $TUI.L.

This European travel company has been very popular among Czech investors lately.

On the one hand, they say the market is always right, but at the same time I really (like everyone else here) can't find a rationale for this steady decline. I think any minor catalyst would be enough to kick-start growth...

Read more

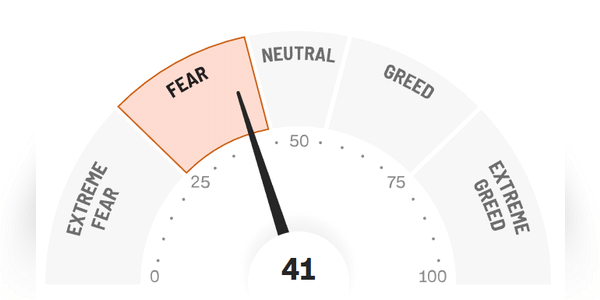

On July 31 we were at 77 points, extreme greed. We've been going down ever since.

Yesterday was a pretty hairy day.

$WPC is down more than 7% today on news that the board has approved a plan to exit office assets within its portfolio.

This plan includes:

1) Spin-off into a separate publicly traded REIT, with 59 office properties to be transferred to Net Lease Office Properties (NLOP).

2) Sale of office assets: 87 office properties will remain owned by $WPC and will be sold by January 2024.

The...

Read more

Zobrazit další komentáře

I was very interested in WPC. However, I have mixed feelings about this news and will wait a while to buy.

How do you currently view $ENPH? I might be more interested in your view on any short-term moves - do we go any lower? Personally, I don't think we'll see too much growth here until the Fed pivot. Strong support should be at $110, now we just need to break the $119 level.

P/FCF: 19.59 and even the P/E ratio, which didn't look that attractive until recently, is now 31, which is...

Read more

Zobrazit další komentáře

Nice report, I've also seen some action but I'm also holding back. Like, if the legalization thing went through it would be a big deal, but as you write, there's probably a lot that would still have to be accepted around it...the drug just is, but so are other drugs and things in this world. 😊

Altria($MO) raises its dividend again after a year, increasing 4.3% to $0.98/share quarterly. At the current share price, that's a 9.1% yield.

Altria now has the highest dividend yield of any tobacco company (followed by $BTI at 9%).

But this can also be viewed negatively. Some investors would welcome more debt reduction or buybacks. Personally, I am of the same opinion.

How do...

Read more

Zobrazit další komentáře

I have a feeling that the divi in those numbers isn't exactly sustainable for them long term right now. After all, they don't exactly have a small debt

Zobrazit další komentáře

I completely agree. It was late yesterday. But these steps are really necessary.

I don't have a clear answer here, but I probably trust Tesla the most.