It's been a week since my request to XTB and eToro support to add shares to their platforms (see my recent post). It was a $RICK stock and many of you were interested in the outcome.

Unfortunately, I'm not going to make you happy, but the title was not added on either platform.

eToro only acknowledged my request. Unfortunately, I don't know if I will be informed further, but I...

Read more

Rickie Reeve

Tyson Foods($TSN) wants to sell its Chinese poultry business

US meat processing and frozen food company Tyson Foods plans to sell its Chinese poultry business. This was reported by Reuters.

$TSN has four research and development centers, several processing plants and dozens of breeding farms in China. It has been operating in the country's entire poultry sector, from breeding and...

Read more

Zobrazit další komentáře

Well, that's interesting news. If this helps reduce the company's debt and the company focuses on its core markets, that's great. I have this stock on my watchlist and will continue to follow it.

Zobrazit další komentáře

I watched it from the beginning and when they had so few users within a few days, I knew it wasn't going to be a big deal :)

Active ExxonMobil($XOM) board member Jeffrey W. Ubben made 2 trades earlier this week, buying a total of 650,000 shares of $XOM stock. That's an amount worth over $69 million. That's a lot of money, don't you think? 😉

Jeffrey W. Ubben is a respected portfolio manager and co-founder of ValueAct Capital, a hedge fund that has beaten the SP500 index over the long term.

I may yet...

Read more

Zobrazit další komentáře

Now that's a decent purchase and a decent bat :D. I'll have to check out that $XOM.

Some information from today's Bank of England meeting:

Interest rates are expected to rise 25 points from 5.00% to 5.25%.

Further increases are in play if price pressures persist. Some of the inflation risks could start to crystallise. The BOE also raised inflation expectations for 2024 from 2.25% to 2.5% and for 2025 from 1% to 1.5%.

Further, the BoE still expects the UK to avoid...

Read more

Zobrazit další komentáře

Great, thanks for the summary, I finally have a glimpse of what's going on in England again😁.

$SOFI was up in pre-market thanks to another great quarter.

They posted a loss of 6 cents per share, which was 1 cent less than expected. Revenues also beat expectations.

What is key, however, is the increase in FY2023 guidance EBITDA to $333-$343 million from the previous $268-$288 million and a 44% year-over-year increase in users. Personal loans also grew in a big way (+51%...

Read more

Zobrazit další komentáře

I have a feeling that somehow the bag of investors in $STLA has been ripped open (probably due to very satisfactory results). Beware, it's not Tesla, but Stellantis - the world's fourth largest automaker in 2022.

And if you haven't heard of this holding company, here are some brands you'll be familiar with.

Read more

Zobrazit další komentáře

So I looked at the stock in more detail and I quite like it, I'm putting it on my radar and I'll consider buying it when there's a discount :3

$BTI reported results today. There were no negative surprises, which is fine.

Key issues remain: declining US cigarette volume and weaker performance in heated tobacco. In addition, the environment is becoming more complex in the e-cigarette segment. This segment is key to NGP (new growth products) profitability targets in 2024. There is a continuing risk of a menthol cigarette...

Read more

Zobrazit další komentáře

Super thanks for the summary. I have shares of $BTI in my portfolio and I'm happy with the results as well.

You may have noticed that the $MMM results were satisfactory, we saw more than the 5% jump I was hoping for. In the end, even I, originally a fan of 3M, sold my entire position. Litigation creates a lot of uncertainty and this was an opportunity for me to sell at a profit and accumulate more cash.

SP500 is slowly at 4600 points, so maybe that cash will come in handy. 😉

Read more

Zobrazit další komentáře

I am still holding $MMM stock and waiting to see what happens next and I have faith that the lawsuits will be resolved and the stock will rise even more. However, I will definitely not be buying MMM stock anymore.

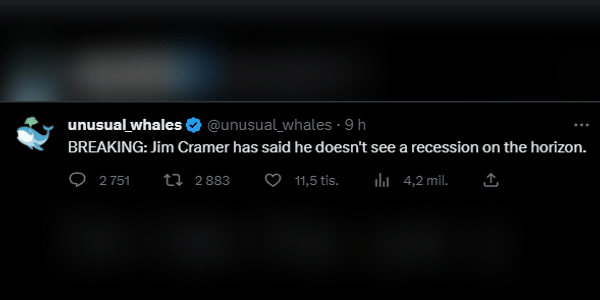

You've probably noticed that stock market growth in 2023 has been very lopsided. Our famous tech seven (Amazon, Meta, Tesla, Apple, Microsoft, Nvidia, Google) are up nearly 60% year-to-date.

The other 493 stocks in the S&P 500 are up just 4%.

That large stocks dominated the stock market in the first half of 2023 is not unusual. In fact, it's quite normal. Optimism and greed are...

Read more

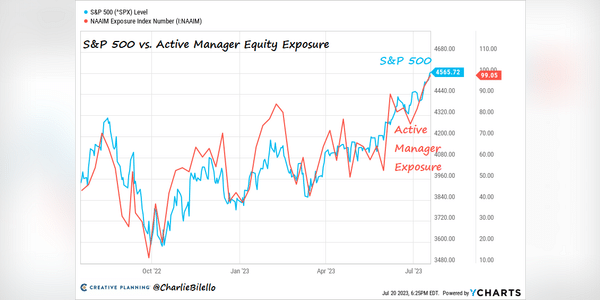

This chart gives us a nice picture of the behavior of most active stock managers. Simply buy high - sell low. Like a flock of sheep, copying fear & greed sentiment.

Zobrazit další komentáře

Such a paradox... yet these people should understand and have the trend exactly opposite :-D

Other reports suggest that Ford $F doesn't have a bright tomorrow.

Ford announced Monday that it will cut prices on all versions of its F-150 Lightning electric pickup truck, with the cheapest version coming in at $50,000, about $10,000 less than originally estimated.

Additionally, I came across this chart yesterday that rates interest on car loans in the U.S. In simple terms,...

Read more

Zobrazit další komentáře

I don't own Ford stock and probably don't plan to include it in my portfolio. However, I'll definitely be watching $F's results next week.

Interesting, thanks for the info and if anything changes I would certainly appreciate an update.