$SOFI was up in pre-market thanks to another great quarter.

They posted a loss of 6 cents per share, which was 1 cent less than expected. Revenues also beat expectations.

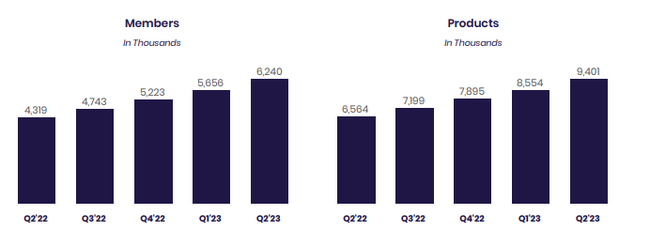

What is key, however, is the increase in FY2023 guidance EBITDA to $333-$343 million from the previous $268-$288 million and a 44% year-over-year increase in users. Personal loans also grew in a big way (+51% yoy). Nice numbers.

That 15%+ short interest could hurt some. Shorting is why the stock didn't rise as much as we would have expected in the pre-market. The share price is very volatile.

This slipped through my fingers again, literally.... :(

Nice work guys who all still hold. I have already collected a profit here for the first time as it came to less than 10$ where I had a purchase of around 6$. I should have been more patient and left it till now, the business is probably good but I'm still scared of this one, the loans ... well it's not a big bank after all but hopefully we don't have to expect crashes anymore. Seeing this, it's tempting to jump in again, but at this price anymore ...I don't know, what do you think?

With today's surge I sold some of the stock, had a nice 130% gain there as we talked about it. However, I continue to hold most of it and will for a long time. What about you, what do you do after a rise like that? I was going to try some options for today, but I don't really know what or where yet. Too bad...would have taken a nice profit with today's surge.

I overpriced it a bit when I was shopping at $14, but I stayed and lowered the price as much as I could. After this year, I'm at something like 60%+ and intend to keep going.