US stocks: will the year-end rally come? This argument weighs trillions of dollars

Something quite logical went hand in hand with the rise in rates and bond yields, and the inversion of the yield curve in the US, namely the sharp rise in the amount of money in US money market funds. There is well over USD 5 trillion in them, and this at an appreciation rate of over 5%. But at...

Read more

Willard Spencer

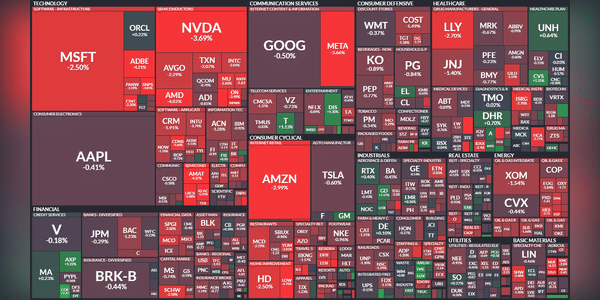

US stocks weaken sharply on Tuesday as investors fear higher interest rates

US stocks fell sharply. Concerns persist in the market about the negative impact of high interest rates.

The Dow index, which includes shares of thirty leading US companies, lost 1.14% to end trading at 33,618.88 points. The broader S&P 500 index fell 1.47% to 4 273.53 points and the Nasdaq Composite...

Read more

Maybe not, but what if: In the event of a recession, a tens of percent gap opens up for US stocks

Is the US heading into a recession? Economists disagree, of course, but in recent weeks they have tended to look for a smooth economic landing. But the dynamics of some economic indicators and the long-term and pronounced inversion of the US government bond yield curve warn against...

Read more

Zobrazit další komentáře

Very interesting information and an interesting chart. I currently have no idea if a recession is coming or not, but thank you for this post :D

Zobrazit další komentáře

It looks very dead now, but it could surprise like in 2021. I'd rather avoid it, but I'm keeping my fingers crossed.

Fidelity: The rally in energy stocks is not over, the sector is at the beginning of a new cycle

Last year, energy stocks benefited from rising oil and gas prices and a number of geopolitical risks, with the energy sector adding over 40% to the US S&P 500 stock index. This year, since the beginning of January, the energy sector has added just under 5%, but there is no reason to...

Read more

Zobrazit další komentáře

Thanks for the summary. There are a lot of companies linked to oil and some have a dividend based on oil prices. Investors are happy right now, but drivers aren't so happy...

US stock indices fell slightly on Tuesday, the dollar did not do well either.

Stocks in the United States weakened. Investors steered away from riskier investments ahead of the U.S. central bank's monetary policy decision. Large technology companies sensitive to interest rates, such as Amazon and NVIDIA, lost significantly.

The Dow fell 0.31% to 34 517.73 points, the broader S&P...

Read more

Zobrazit další komentáře

The drop was much bigger during the day, but eventually the stock pulled out of it somehow. We'll see how it goes today after the Fed :)

Zobrazit další komentáře

Super summary. We're honestly curious to see what the outcome of their AI will be.

Where $AAPL, there goes the whole market or a warning to stock bulls.

Shares of Apple lost 1.71% on Tuesday, the day it unveiled new devices led by the iPhone 15. They are still writing off over 10% from their all-time high on August 1, and are thus in a correction. Investors who put money across the board in the S&P 500 would certainly like to see better stock market...

Read more

Zobrazit další komentáře

It's true that the company hasn't been doing well the last few days, but I think it won't last long and in a few days everything will be like before or even better :)

Zobrazit další komentáře

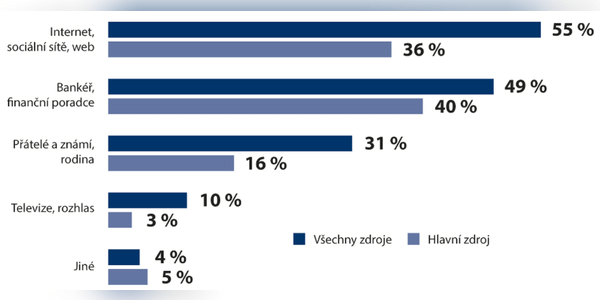

3-10% TV and radio, that probably hurts me a bit. Seems to me that if there's any talk of a stock on TV or radio, it's time to sell :D

US bonds can rewrite history. This has not happened in the market in 250 years

Ten-year US government bonds may see their third consecutive annual price decline this year. As strategists at Bank of America point out, this is something that has never happened in the roughly 250-year history of the United States. Bunds fell 3.9% in 2021, are down roughly 17% in 2022, and have...

Read more

Zobrazit další komentáře

I've been thinking a lot about bonds for the last month, but in the end I stuck with stocks

What you need to know in the morning (September 8)

1. U.S. stocks closed mixed on Thursday, with the S&P 500 and Nasdaq Composite weakening on Apple

Stocks in the United States closed mixed on Thursday. The S&P 500 and Nasdaq Composite indexes fell due to a drop in Apple shares. A drop in new jobless claims in the US added to concerns about interest rates and persistently high...

Read more

Real estate funds in 2023: Time to rest after last year's records

The average net return of real estate funds in the first half of the year reached 2.5%. None of the 33 real estate funds in the Czech Republic outperformed the inflation rate in the first half of this year, while three real estate funds posted losses.

The first half of this year was below average for real estate...

Read more

Bank of America: Hedge funds are bracing for worse times and are overconfident in these 20 stocks (part 2).

Continued from yesterday's status:

11. Lamb Weston

Sector: essential consumer goods and services

Difference in LONG and SHORT positions: 10.1%

12. Bio-Rad Laboratories

Sector: Healthcare

Difference in LONG and SHORT positions: 10 %

13. Viatris

Sector: Healthcare

Difference in LONG...

Read more

Zobrazit další komentáře

Fair Isaac's performance here is truly admirable, at least the one that's shown on the chart. I guess it's too late to go long there...

Bank of America: Hedge funds are bracing for worse times and have above-average confidence in these 20 stocks (Part 1)

Although the data from the U.S. economy is fairly solid, hedge funds are not really overly optimistic. Defensive positions outweigh cyclical ones in the portfolios of funds that can bet on both LONG and SHORT. Which stocks do hedge managers trust the most in...

Read more

Zobrazit další komentáře

Well, nice charts, thanks! I know a few companies, but I'm not so sure about others. The recession is not the main issue now, so the markets are still rising. We'll see how it looks at the end of the year if we see a Santa Claus rally ;)

So far it looks like the end of the year could be pretty green. History also shows it, but a lot of unexpected things can still intervene.